The Australian share market just suffered from its worst October since 2018, with the S&P/ASX 200 Index (ASX: XJO) falling 3.8%.

While pessimism is ruling most sectors, there are two industries that are especially in a rut — retail and travel.

With consumers carrying the burden of 12 rapid interest rates rises, the outlook for retailers is understandably poor.

Travel businesses have cashed in over the past 18 months from pent-up demand arising out of the COVID-19 lockdown era. But the party is well and truly over now.

"Travel stocks have all materially de-rated over recent months, down around 30%, on the expectation that cost of living pressures and the end of 'revenge travel' will most likely see travel spend fall in the next 12 months," said Maple-Brown Abbott portfolio manager Matt Griffin.

A contrarian view on travel and retail

Griffin, though, thinks the market has misjudged the fortunes of the travel sector.

"We are relatively positive on the sector for a few reasons. Firstly, leisure travel has proven to be extremely resilient in past downturns – provided people have jobs, they will take leave and travel," he said.

"Secondly, increased airline capacity and falling airfares will draw more people back to longer haul flights, especially families. And finally, many Asian countries have been slow to recover from COVID lockdowns and this will be a tailwind in 2024."

His team remains "generally negative" on retail, but Griffin reckons gems can be found in specific categories.

"For example, apparel is fairly weak due to over-stocking and competition, while less discretionary goods such as auto parts are holding up relatively well.

"With foot traffic to many stores falling materially, the coming year will be a chance for the quality retailers to shine, as differentiation around product range, price points and customer service drives better sales results."

So are there specific shares that Griffin's team is backing in those industries?

The ASX 200 stocks that this expert favours

Griffin noted that retail businesses with "internal growth drivers and solid execution are outperforming those with less self-help initiatives".

As such, his top pick in consumer discretionary is Super Retail Group Ltd (ASX: SUL).

Over in travel, Griffin's team likes Webjet Limited (ASX: WEB).

"They both fit our process well, offering good medium-term earnings growth, and have resilient business models [even] if conditions for the consumer worsen."

Webjet shares are in a significant dip at the moment, perhaps presenting a buying opportunity. The share price is down more than 22.7% since the end of July.

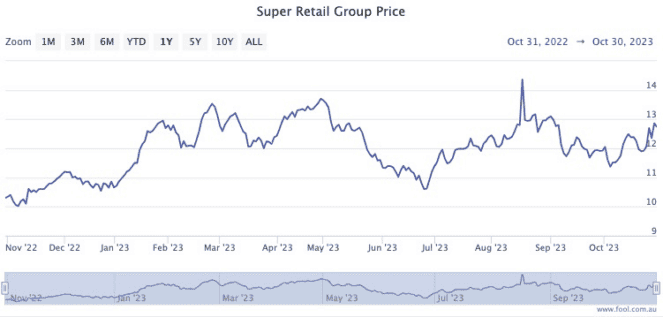

Meanwhile the market seems to appreciate Super Retail's strength in a difficult environment, sending the shares 22.4% up so far this year.

Super Retail also has an outstanding 7.8% fully franked dividend yield that makes it a tempting buy.