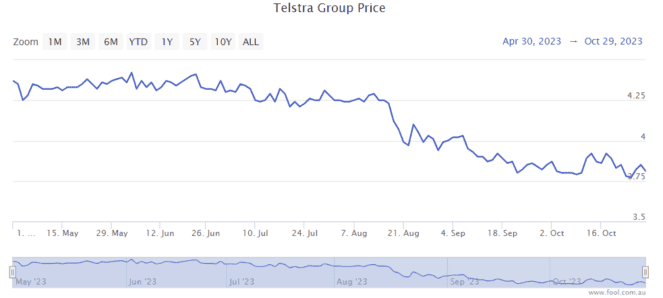

The Telstra Group Ltd (ASX: TLS) share price has been going downhill over the last few months, as we can see on the chart below. It's down close to 14% from 21 June 2023.

We're in an interesting time, considering inflation remains stubbornly higher than desired and interest rates have increased to compensate. There's a fair chance that the RBA interest rate will rise again in November.

The Telstra share price, and all share prices, are meant to be forward-looking. Profit rose in FY23, so what's the outlook for higher profit in the near term and longer term?

Profit to keep rising?

Telstra itself has provided guidance that it expects its earnings before interest, tax, depreciation and amortisation (EBITDA) to rise between 2.5% to 5% despite all of the negative impacts from inflation on its cost base.

One of the main things that is helping Telstra offset the costs is that Telstra's revenue is rising. Telstra has been increasing its mobile prices for subscribers in line with inflation, which is a very useful organic boost.

The broker UBS recently commented that mobile postpaid prices are "generally sticking better than expected" which makes it believe that Telstra can deliver on postpaid average revenue per user (ARPU) growth in FY24.

Why are customers putting up with higher prices? UBS suggested it was because of "continued improvements in Telstra brand perceptions on network coverage, reliability and fast internet speeds."

UBS said that Telstra "continues to lead the market on across the board price growth – prepaid, wholesale, which we view positively for continued rationality in industry dynamics." I'd suggest the revenue growth may be one of the biggest influences on the Telstra share price and profit in the next year or two.

On the cost side of things, Telstra has been working hard to reach a $500 million net 'cost out' target by FY25 as part of its T25 strategy.

Despite the elevated inflation environment, UBS thinks Telstra will be able to hit the target. A few months ago, the ASX telco share revealed a headcount reduction of around 472, which could save between $70 million to $90 million. There's also the potential for subscribers to move onto fixed wireless and off the NBN, so Telstra would be taking more of the margin.

Continuing on cost reduction, UBS notes that Telstra is decommissioning legacy infrastructure as well as targeting use of AI in key processes. UBS sees scope for further efficiencies beyond FY25 "from operational efficiencies and optimisation of InfraCo Fixed as it is re-integrated into the Telstra structure."

Telstra share price valuation

UBS' current forecasts suggest that Telstra's earnings per share (EPS) and dividend per share could increase each year between FY24 to FY28.

Looking at just FY24, Telstra may generate EPS of 19 cents and pay a dividend per share of 18 cents.

That would put the Telstra share price at 20 times FY24's estimated earnings with a grossed-up dividend yield of 6.75%.