It's a fact of life that sometimes stocks for even high quality S&P/ASX 200 Index (ASX: XJO) businesses are discounted by the market.

It's worth remembering in these situations that share prices are driven purely by supply and demand for the equity, not company performance or outlook.

Therefore, it's not out of the question to pick up ASX 200 shares for an absolute bargain occasionally.

But you have to pounce, as the buying window might be pretty short as other investors cotton on.

Here are two such examples from experts this week:

'Buy a better-than-average quality company at a discount'

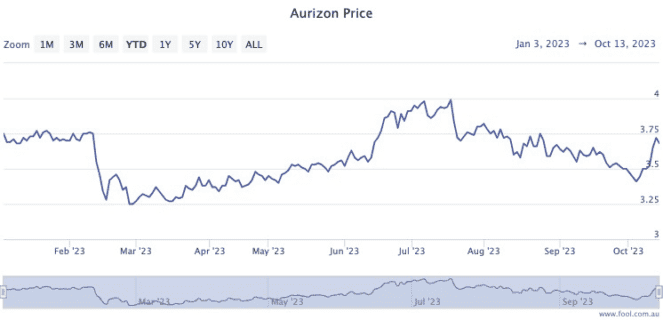

The Aurizon Holdings Ltd (ASX: AZJ) share price has fallen 9.75% since mid-July.

For longer-term investors, it's been even more of a horror show, as the stock is down 40% since its pre-COVID September 2019 high.

Ord Minnett senior investment advisor Tony Paterno feels the freight rail company has been punished enough.

"Aurizon offers an appealing dividend yield underpinned by high-quality rail infrastructure and haulage operations," Paterno told The Bull.

"Considerable downside is priced into the shares, and our analysis suggests that risks for investors are skewed to the upside."

The yield is indeed at a tidy 4.15%, which is 60% franked.

La Nina had dented Aurizon's performance in the immediate past, but that factor's now gone with El Nino coming to the Australian east coast.

"Haulage volumes were weak in fiscal year 2023 because of wet weather, but the outlook suggests a recovery in volumes.

"We expect haulage tariffs to rise with the consumer price index."

All this points to a golden buying opportunity, reckons Paterno.

"We think environmental concerns are overblown, providing an opportunity for investors to buy a better-than-average quality company at a discount."

The stock that returns both 'capital growth and dividends'

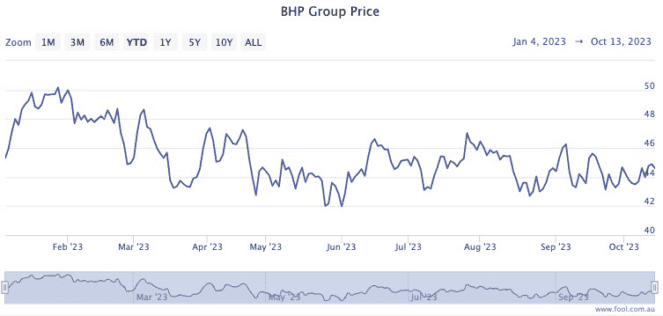

BHP Group Ltd (ASX: BHP) shares are also currently trading about 9.5% lower than its January peak.

BW Equities equities salesperson Tom Bleakley is bullish about one of BHP's minerals that doesn't get a whole amount of publicity.

"We expect the mining giant to benefit from increasing demand for copper as the world transitions to electric vehicles," he said.

"BHP operates some of the world's biggest copper mines."

And of course, the advantage of buying into a $229 billion company is that it has plenty of other stews on the stove, too.

"The company offers diverse revenue streams from producing iron ore, nickel and metallurgical coal," said Bleakley.

"The shares offer value at recent price levels. Investors can consider buying BHP for capital growth and dividends."