Much mystery remains about how the economy might look in a year's time.

With such insecurity, it's no wonder many investors are seeking out passive income right now.

So which ASX dividend shares are the best placed to provide you regular income in the current market?

Check out these three suggestions:

'Energy deficits' will only mean one thing

Regular drivers would already be aware petrol prices are sky-high at the moment compared to even six months ago.

Despite the gloomy global economic outlook dampening demand, supply is deliberately being choked by the oil producing nations to elevate crude prices.

This is why Ampol Ltd (ASX: ALD) shares are trading 21% higher than when the year started.

The fuel distributor and retailer, despite the stock price rise, is paying out a sweet dividend yield of 7.43%, which is fully franked no less.

JPMorgan Chase & Co (NYSE: JPM) analysts this week expressed their bullishness on Ampol.

"Without increasing oil and gas capex, we risk energy deficits and acute inflation across the commodities complex.

"This may lead to multiple oil-led energy crises in this decade, potentially much more severe than the gas crisis seen in Europe in 2022."

Ampol shares enjoy wide popularity among professional investors. According to CMC Markets, eight out of 11 analysts currently rate the stock as a buy.

'A history of distributing attractive dividends'

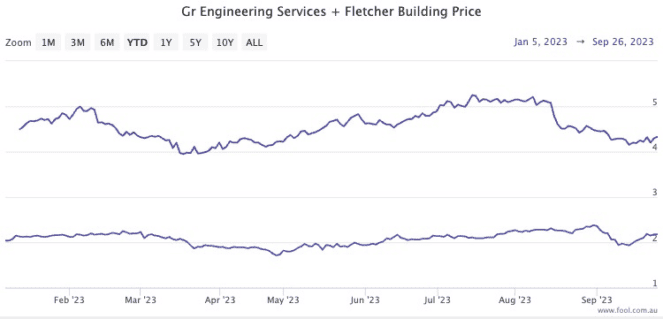

GR Engineering Services Ltd (ASX: GNG) is not a household name among investors, but perhaps it should be.

The services provider is paying out an excellent 9% yield, which, like Ampol, is fully franked.

Argonaut and Euroz Securities both currently recommend the stock as a strong buy.

"The company has a history of distributing attractive dividends to shareholders," said Argonaut associate dealer Harrison Massey.

"The company has a strong future pipeline of work, and the current order book includes BHP Group Ltd (ASX: BHP)'s $312 million West Musgrave mine project."

The little doer going gangbusters across the ditch

As a New Zealand company, Fletcher Building Ltd (ASX: FBU)'s dividends are not franked at all.

But it's still yielding a very respectable 7.43%.

And with interest rate hikes potentially ceasing soon, the building industry could be on the way up.

All those projects will need supplies, and Fletcher Building could cash in.

The Motley Fool reported this month that the Kiwi outfit conventionally targets paying out 50% to 75% of net earnings.

Future prospects are apparently looking good, with a remarkable 10 out of 14 analysts rating Fletcher as a buy.