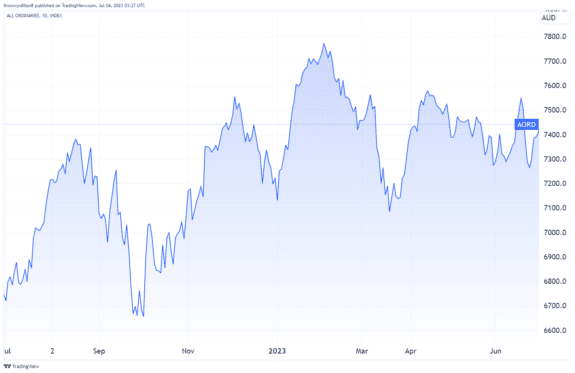

ASX All Ords shares closed out FY23 with a solid 8.85% gain but as shown in the chart below, it was a rollercoaster ride that most of us would never want to be on!

The S&P/ASX All Ordinaries Index (ASX: XAO) experienced a tumultuous 12 months as investors worried about rising inflation and interest rates.

However, the index managed to gain 655 points, rising from 6,746.5 points at the close on 30 June 2022 to 7,401.5 points on 30 June 2023.

The ASX All Ords captures the performance of the 500 largest listed companies by market capitalisation.

Here are the star performers of FY23 based on share price growth, according to S&P Global Market Intelligence.

The No 1 ASX All Ords share is a retailer!

The Cettire share price recorded the highest growth among the 500 ASX All Ords shares in FY23.

Cettire Ltd (ASX: CTT)

Who would have thought, with all the fear around rising inflation and its impact on consumer discretionary spending, that a retail share would dominate the ASX All Ords in FY23?

Luxury brands online retailer Cettire blew every other ASX All Ords share out of the water with its 718% share price growth in FY23.

Cettire shares closed FY23 at $2.96. In earlier trading yesterday, the stock hit a new 52-week high of $3.40, up 6.9%.

Some economists speculate that the reason inflation is falling slowly in Australia is because the wealthy are still spending. Cettire's annual performance is a case in point.

As we recently reported, Cettire's sales of luxury brand products are accelerating.

Wilson Asset Management dealer Will Thompson reckons this ASX All Ords star is still a buy despite its outstanding price growth in FY23.

He says the Melbourne-based company is "quite a small player in a big market, and they're growing quickly".

He adds: "There's not a big amount of luxury brands that sell online. So they're getting the benefit of that."

Here are the other top ASX All Ords shares of FY23

Latin Resources Ltd (ASX: LRS)

The Latin Resources share price skyrocketed in FY23 by 408%. The ASX All Ords lithium share really caught fire in May after the company released an update on its flagship Salinas Lithium Project in Brazil. In the last few days of FY23, the company announced confirmation of a "district scale lithium corridor" at the site.

Neuren Pharmaceuticals Ltd (ASX: NEU)

This ASX All Ords healthcare share ripped 222% higher in FY23. The key driver was the US Food and Drug

Administration's approval of a drug called Daybue, which is being marketed by Neuren's North American partner, Acadia Pharmaceuticals (NASDAQ: ACAD). The drug is the first and only approved treatment of Rett syndrome, which is a rare, neurodevelopmental disorder affecting 6,000 to 9,000 people in the US.

Lindian Resources Ltd (ASX: LIN)

This ASX All Ords mining share had a cracking year with 200% price growth in FY23. Lindian is a bauxite miner with projects in Tanzania. Much of its success in FY23 was due to its acquisition of the "globally significant" Kangankunde Rare Earths Project in Malawi. This was announced on 1 August. Since then, Lindian has reported a series of high-grade assays that have helped continually lift the share price.

Smartpay Holdings Ltd (ASX: SMP)

Payment solutions provider Smartpay enjoyed a terrific year with a share price gain of 197% in FY23. The Australia and New Zealand EFTPOS business reported a 637% improvement in net profit before tax in its FY23 half-year results. Wilson Asset Management says the small-cap has more room for growth and is successfully "capturing market share from its key competitors".

For more insights on the best-performing Australian stocks of FY23, check out our story on the top 5 ASX 200 shares of the year.