The Fortescue Metals Group Ltd (ASX: FMG) share price struggled to outpace its peers on Tuesday as rumours circulated.

At the close, shares in the iron ore major were up by 0.31% to $22.40 apiece while the materials sector basked in a greener gain of 0.91%.

Lacking any announcements or substantial moves in iron ore prices, whispers of Fortescue joining the fight to acquire an energy company might have cramped its style today.

But which feather is Fortescue possibly looking to add to its cap?

Is this customer having a crack?

After providing the Pilbara region with power for more than 40 years, Alinta Energy began scouting potential suitors earlier this year. It is said the electricity and gas retailer is looking to sell at least an 80% stake in some of its Western Australian assets.

According to reports from The Australian today, Fortescue is believed to be back in the race after earlier dropping off the list.

Joining formidable bidders — including Macquarie Group Ltd (ASX: MQG), BP, and APA Group (ASX: APA) — the iron ore miner could have a chance at adding a power station and battery storage system to its big box of toys.

However, a condition of rejoining the stoush is thought to be an amendment to 'aspects' of its original proposal.

A deal with Fortescue is possibly muddier than with others due to Alinta's current customer list. Servicing the headline mining region, it comes as no surprise that Fortescue, Hancock Prospecting, and BHP Group Ltd (ASX: BHP) are all considered 'main customers'.

If Fortescue were to take ownership, it could present a risk over energy security for what are effectively competitors of the Twiggy-led company.

Current estimates price the sale somewhere in the range of $500 million to $1 billion.

Is the Fortescue share price outpacing the competition?

In an industry where you are unable to differentiate from your peers on the product, cost becomes the focus. A chance at acquiring Alinta Energy could offer an opportunity to strip out the added margin in energy costs for the winning bidder.

Taking a quick look at earnings margins, Fortescue has managed to deliver greater profit margins than BHP and Rio Tinto Ltd (ASX: RIO). Part of this could be attributed to different material mixes, but low operational costs likely play a role.

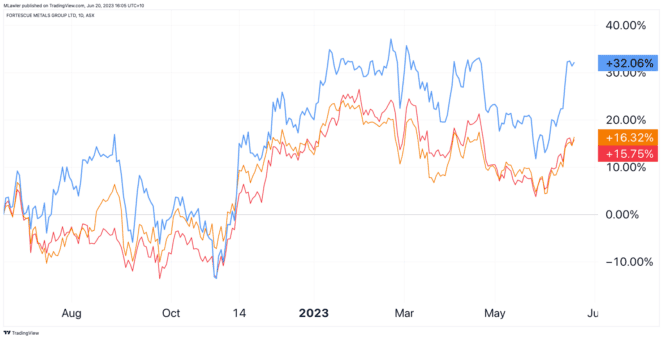

In turn, shareholders have rewarded these greater margins. The Fortescue share price has rallied 32% in the past 12 months, compared to 16% and 15% gains from BHP and Rio Tinto respectively, as shown above.