There is no question ASX 200 lithium stocks have been the gift that just keeps on giving over the past few years. However, the consistent 'up and to the right' trajectory of these investments could now be in jeopardy according to some analysts.

The doubt surrounding producers of the critical electrifying material began to creep in towards the end of January. Since then, many of the most popular lithium shares on the ASX have experienced dwindling share prices.

Yesterday, analysts added to the waning optimism amid 'negative' industry developments.

Is the demand landscape shifting?

Evergrowing demand for electric vehicles (EVs) — and the batteries they require — has been an integral component of sustained lithium demand at elevated prices. If this is to be believed, it must also apply if the reverse is true — declining battery demand.

For the last two years, such a scenario would almost be considered unfathomable. Today, though, the environment is certainly different.

The unwavering determination of central banks to crush inflation has upsized the possibility of a recession. Even one of Australia's major banks, National Australia Bank Ltd (ASX: NAB), is forecasting Australia's economy to fly daringly close to the sun over the coming quarters.

Hence, the possibility of falling demand for EVs wouldn't be completely unfounded.

This year so far has witnessed lithium carbonate prices tumble around 30%. As pictured above, this has occurred hand in hand with falling growth in China's EV sales. Now analysts are concerned about the reduced demand flowing upstream.

Yesterday, Morgan Stanley highlighted a move from CATL — one of the world's largest EV battery manufacturers — to sell some of its batteries at a significant discount to spot prices.

In our view, this may be reflective of CATL's concern on the overcapacity issue and slowing EV demand, and its expectation that lithium prices will further normalise in coming years. We think discounting is expected to impact pricing expectations negatively.

Rachel Zhang, Morgan Stanley equity analyst

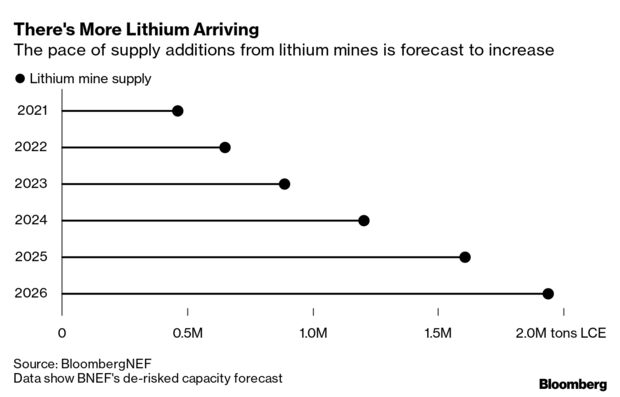

Analysts are also worried about the supply side of the equation, dousing added fuel on the fire for ASX lithium stocks. Ark Invest's Cathie Wood believes skyrocketing lithium prices will have incentivised additional supply which is expected to come online over the coming years, as shown below.

Are ASX 200 lithium shares still outperforming this year?

The cratering lithium price has not prevented some ASX lithium shares from continuing their upward trend this year. While the S&P/ASX 200 Index (ASX: XJO) is up a solid 4.7% year-to-date, the following lithium companies are outpacing it:

- Allkem Ltd (ASX: AKE) up 5.3%

- Mineral Resources Ltd (ASX: MIN) up 13.1%

- Pilbara Minerals Ltd (ASX: PLS) up 21.3%

Morgan Stanley currently holds an equal weight rating on Mineral Resources. Whereas Allkem and IGO Ltd (ASX: IGO) are two ASX 200 lithium stocks that the broker is underweight on.