Is the National Australia Bank Ltd (ASX: NAB) share price a bargain buy right now?

The NAB share price is looking cheap today. That is if you look at how NAB has historically been priced.

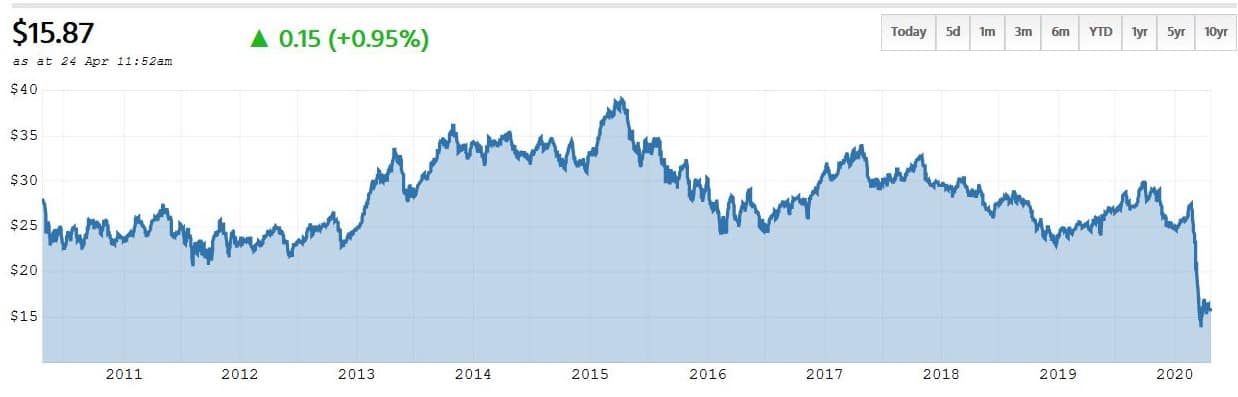

Today, NAB shares are trading for $15.87 (at the time of writing). And that's after rallying around 20% over the past month. Yes, that's right, NAB shares found a low back in March of $13.20 – an unprecedented level this century.

For some perspective, NAB hadn't been below the $20 mark since the GFC over a decade ago. And even then, this ASX bank only dropped to around the $16 mark. What's more, that was during a financial crisis, not a health one.

You literally have to go back to the 1990s to find a time when you could pick up NAB shares for their current price.

Just take a look at this graph for some visual conveyance!

Does this mean NAB shares are a bargain right now?

Well, it depends on your definition of a 'bargain'. Just from looking at historical share prices for NAB, you might be tempted to say yes. But a company's value is really what determines whether something is a bargain. Warren Buffett always likes to tell us that 'price' and 'value' are not one and the same.

So when we look at the potential for NAB as a business to return cash to us as a potential owner, that's when things look a little murkier.

NAB is a bank that focuses more on the business side of banking. Its loan books are more heavily skewed to business lending, as opposed to a bank like Westpac Banking Corp (ASX: WBC), which has more of a mortgage-heavy balance sheet.

And if you ask me, I would say that business assets are under a much higher risk category in today's economy than loans secured against a property. We don't know yet what the full extent of the coronavirus shutdowns will be on the economy, but very sadly some business closures are a distinct possibility. As well as being tragic for those involved, any business shutdowns will of course also be very bad news for NAB's loan books.

Until we know the extent of this potential, I think it's hard to estimate NAB's earnings going forward and so its valuation right now. Yes, NAB shares might turn out to be cheap in hindsight from here, but I wouldn't say it's dead certain by any means.