The BHP Group Ltd (ASX: BHP) share price dropped 2% today on news of iron ore prices dipping and a production ramp up from Brazilian miner Vale, but is still up more than 22% so far in 2019.

How has iron ore pricing impacted BHP?

The price of iron ore hit a 5-year peak this month, pushing beyond US$125 per tonne and, despite yesterday's 2.4% slide, this performance looks to remain relatively well supported into the second half of 2019.

The main driver of the iron ore rally over the past month is strong continued demand from China, with Chinese May steel output growing at 10% year-on-year, resulting in ongoing reductions in Chinese port iron ore stockpiles. This combined with Rio Tinto Limited (ASX: RIO) cutting their 2019 output due to operational issues, has resulted in a tight iron ore market with both supply being constrained and demand better than expected.

The outlook for BHP

Even given today's movements, the state of the iron ore market bodes well for BHP's earnings outlook as I believe it's the best positioned diversified mining house listed on the ASX.

BHP has high quality, long-life assets that ensure it will remain a global low-cost producer, particularly the Western Australian Iron Ore complex, which delivered a 28% return on capital employed (ROCE) in 2018. This is set to rise further in 2019 with the elevated iron ore price. I believe that this is not currently reflected in the BHP share price of $40.45, and I have a target price of $47 in the short-term.

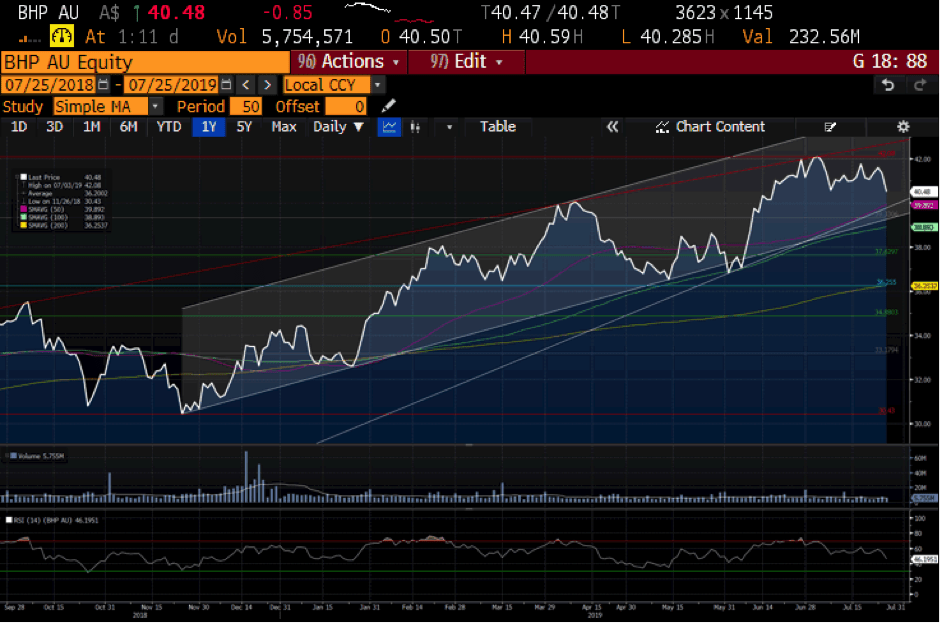

The chart below highlights BHP's bullish run over the past year.

In addition, I rate BHP's management under CEO Andrew Mackenzie as very disciplined when it comes to capital expenditure and acquisitions. This discipline is evidenced by the fact that, after completing the sale of its US onshore shale oil business in November 2018, the company then completed a $5.2 billion off-market buyback of BHP Ltd shares. This equated to 8% of the BHP Ltd share count and a $5.2 billion special dividend in January 2019.

The massive leverage to BHP's earnings of higher sustained iron ore prices over the past few months cannot be underestimated. According to its latest set of results, a US$1 per tonne increase in the iron ore price results in a US$225 million increase in its underlying earnings before interest, tax, depreciation and amortisation (EBITDA). This translates into an expected $14 billion in free cash flow generation, which enables the company to further reduce its debt and increase its dividends.

Therefore, I expect a robust dividend given the current level of iron ore profitability and low debt. In addition, BHP has confirmed its commitment to maintain a 50% dividend payout ratio and so expect it will pay a 56 cents per share special dividend at its full-year results on 20 August, on top of an 121 cents per share ordinary dividend. This puts the company on a 4.5% dividend yield.

Foolish takeaway

In a world of negative interest rates, BHP is offering a 4.5% dividend yield at a 12X forward PE. This a compelling valuation and offers real value in a high quality resource business that is poised to generate significant cash flow in the foreseeable future!