The HUB24 Ltd (ASX: HUB) share price has been a strong performer on Tuesday morning

At the time of writing the award-winning investment and superannuation platform provider's shares are up 6.5% to $13.06.

Why is the HUB24 share price up over 6%?

Hot on the heels of last week's market update, this morning HUB24 released its update for the December quarter.

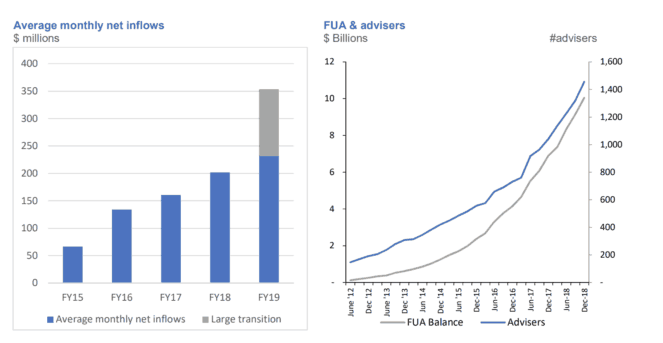

According to the release, the company saw net inflows of $1.5 billion during the December quarter. This is the highest for any quarter to date and up 167.4% on the prior corresponding period. Gross inflows were $1.8 billion for the period.

One key driver of this impressive quarterly performance was the successful transition of Fitzpatricks Private Wealth in-house MDA to the HUB24 platform.

Excluding this transition would mean that net inflows were up approximately $750 million during the quarter. Management advised that this was driven by continued "growth from our adviser base as they win new clients and transition FUA from legacy platforms in order access our market-leading functionality, creating value for their clients."

As you can see on the chart below, even excluding the large transition HUB24's growth in net inflows remains incredibly positive.

Should you invest?

I thought this was yet another impressive quarter by HUB24 and I'm confident it won't be the last.

And while I do see it as being a great investment option, it might be prudent to wait until its half year results are released next month before making a move.

After all, competition in the industry is intense with the likes of IOOF Holdings Limited (ASX: IFL), Netwealth Group Ltd (ASX: NWL), Onevue Holdings Ltd (ASX: OVH), Pendal Group Ltd (ASX: PDL), and Praemium Ltd (ASX: PPS) all offering similar platforms.

There are concerns that this could lead to margin pressure and lower than expected profits. I'd like to see signs that this is not the case before parting with my money.