Tracking the decline in house prices is becoming a national obsession and the losses so far appear mild and orderly, although there are signs that the worst is yet to come in this downcycle.

While it's the top end of the market that is feeling the most pain, the losses are spreading, and the price drops are gaining pace.

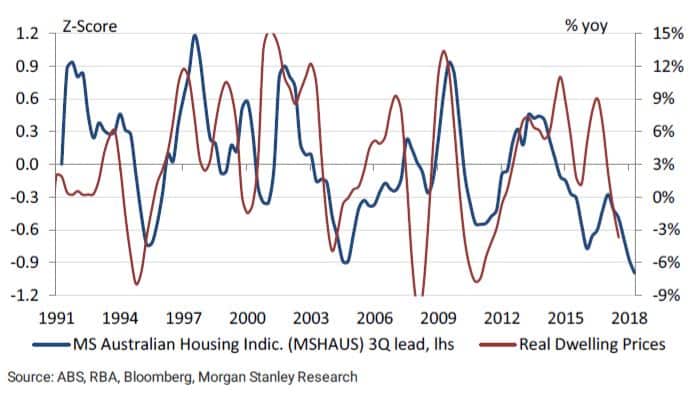

Against this backdrop, Morgan Stanley has developed a price model to predict the downside risks to the residential market and the indicator has fallen to a record low!

This means house prices could fall by more than the 10% peak-to-trough decline that Australia and New Zealand Banking Group's (ASX: ANZ) economists are expecting.

"With the Australian housing correction broadening and deepening, we collaborate with our securitised credit strategy team to assess the risks in the tail of the housing market and the residential mortgage-backed security (RMBS) asset class," said Morgan Stanley.

"Our MSHAUS model points to another 5-10% decline in house prices over the next 9-12 months."

Shaky Ground: Morgan Stanley's lead indicator points to further house price drop

National house prices have already fallen 2.7% over the past 12 months, according to the latest Corelogic data.

Morgan Stanley believes prices may only bottom out when the drop closes in on 13% and that means the number of households with no or negative equity in their homes (where their loan exceeds the value of their home) will increase.

"This cohort would be particularly vulnerable to any employment shock, both in terms of spending, potential forced selling, and even mortgage losses for banks, non-bank lenders and mortgage insurers," added the broker.

This means the share prices of banks like Commonwealth Bank of Australia (ASX: CBA) and Westpac Banking Corp (ASX: WBC) to retailers like JB Hi-Fi Limited (ASX: JBH) and Harvey Norman Holdings Limited (ASX: HVN) are particularly vulnerable to the ongoing housing downturn.

We haven't really seen any shocks to corporate profitability yet, but arrears are increasing even as our economy looks to be in good shape. That's actually alarming as you have to wonder how our market will hold up if our economy hits a speedbump.

"We note an overall deterioration, despite resilient headline GDP and employment growth, with 30d+ arrears for AU RMBS (both prime and NC) for currently outstanding placed prime RMBS are around 1.04% while for NC the metric is at 3.9% – both up from beginning of the year levels," said Morgan Stanley.

"Thus far, QLD and WA have been the main drivers of the uptick, although we also note much weaker performance of >80% LVR mortgages across the book, where arrears are tracking at 3%."

I am currently underweight on sectors that are most sensitive to the property market downturn. We might see signs of improvement over the next few months if Morgan Stanley's model is on the money and only then will I look to buy these beaten down sectors.