The Xero Limited (ASX: XRO) share price traded flat at $41.29 this morning, after the company released its annual results for the 2018 financial year. Here's what you need to know:

- Revenues rose 38% to $406.6 million (all figures in NZ Dollars)

- Annualised Monthly Recurring Revenue (AMRR) rose 33% to $484 million

- Lifetime value per subscriber (LTV) grew 8% to $2,310

- Net loss after tax of $27.9 million, down from a loss of $69.1 million in 2017

- Positive EBITDA of $26 million for the first time

- Cash flow positive with $41 million in operating cash flow, compared to an outflow of $4.4 million last year

- Gross margin improved 4pts to 81%

- Outlook for smaller cash outflow in financial year 2019, Xero expects to manage the business to break-even with no additional funding or debt requirements.

So what?

It was an interesting year for Xero for several reasons, including CEO Rod Drury stepping down and being replaced by Steve Vamos. Xero also experienced a slowing overall rate of growth, with revenue growth of 38% well below the rate of prior years. This is largely due to the increasing size of the business, and slower growth rates in markets like New Zealand and Australia where Xero is already dominant.

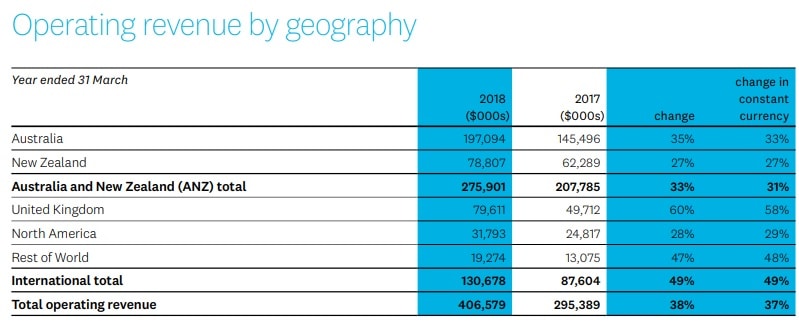

The US business is also struggling (compared to the rest), with Xero seemingly finding it hard to gain traction there. UK growth however continues apace:

Overall the Australian and New Zealand businesses are still the primary drivers of the business. Revenue was up $111 million from last year, with the ANZ region contributing $68 million or 61% of all growth. That will surely taper off at some point due to the small size of this region and the fact that Xero is already dominant here. However, judging by its growth rate there, Xero has cracked the UK market and this is now a larger contributor to earnings than New Zealand.

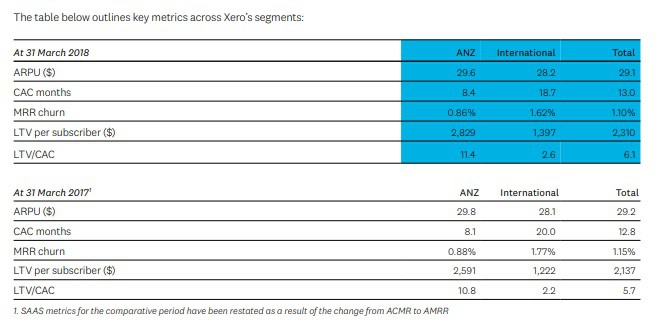

However, in my opinion, the most important table in today's presentations is this one:

You can see that average revenue per user (ARPU; a reflection of what Xero costs) is flat, suggesting Xero may not have increased prices this year. Cost of Acquiring a Customer months (CAC months) reflects how many months it takes to achieve payback of the cost of acquiring that new customer. International growth is far more expensive than domestic growth, although this metric is moving in the right direction. Churn (the number of customers that leave) is also falling, albeit just slightly.

Xero has to keep its customers longer than 8 months (ANZ) or 19 months (internationally) in order to just break-even on that specific customer. As a result the customer experience is paramount and that's why I feel these metrics are the ones to watch.

Now that it's grown substantially in size, Xero is unquestionably maturing and I expect the growth to slow from here. However, I continue to believe that it is a high quality business, and I am happy to continue holding my shares.