"Lower for longer" has been the mantra for a while now and the Reserve Bank of Australia is not in a hurry to lift the official rate. Bloomberg has reported that global investment bank, Morgan Stanley, sees Australia being the last to lift rates compared to other countries. But, rates will rise at some point and could within 12 months.

Many investors have focussed on dividend yield especially if the invested money would have been sitting in a term deposit. A 5%-7% dividend yield before franking beats what the banks are paying for term deposits. But, as rates move up dividend yield plays will become less important.

Australian Real Estate Investment Trusts' (A-REITs) share prices are inversely correlated to interest rates (rising rates leads to falling share prices) as I mentioned previously in Fool.com.au. So, I would be cautious about investing in A-REITs, especially those more heavily indebted.

Another sector that can be hurt by higher rates is infrastructure, which can be a fixed interest proxy and sold off when long bond rates rise.

Infrastructure companies are known for producing reliable income during periods of low interest rates. But, rising rates aren't all bad as this means the economy is doing well, which can support railway operators and airports due to increased demand.

Utility companies that provide services such as electricity, gas, or water, have earnings that are regulated based on their cost of capital. So, as the cost of capital rises (as interest rates rise), so do their revenues.

Infrastructure shares are often uncorrelated to other parts of the share market (so prices should not rise and fall in tandem with traditional shares).

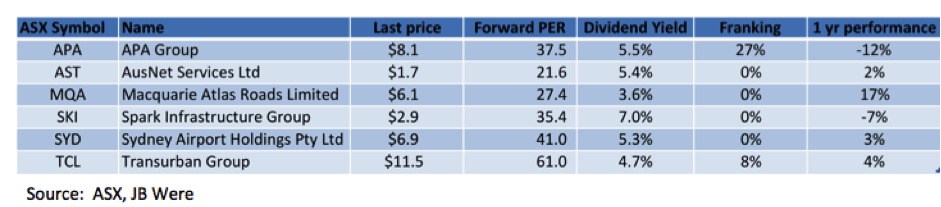

Below is a list of reliable infrastructure companies to consider for an investment.

APA Group (ASX: APA): Is the owner and/or manager and operator of a portfolio of Australian energy assets including a solar farm, gas pipelines, gas storage facilities and a wind farm.

AusNet Services Ltd (ASX: AST): Owns and operates Victoria's primary electricity transmission and distribution network.

Macquarie Atlas Roads Limited (ASX: MQA): Invests in global infrastructure assets including the developing and operating of tolls roads, bridges and tunnels. The company also invests in companies in the same sector.

Spark Infrastructure Group (ASX: SKI): An infrastructure fund, which invests in regulated electricity distribution businesses in Australia and globally.

Sydney Airport Holdings Pty Ltd (ASX: SYD): Owns and operates Sydney Airport providing aeronautical, retail, property, car rental and parking and ground transport services as well as leasing and advertising opportunities.

Transurban Group (ASX: TCL): Developes, operates, maintains and finances toll road networks in Australia and USA.

Companies operating infrastructure assets that have long-term contracts such as Sydney Airport, Transurban and Spark are likely to be better dividend plays, despite low or no franking.

The excessive earnings multiples for many of the companies (as in the table below) make buying now not the best option. Another way to be exposed to infrastructure is to consider a listed fund or ETF that is globally focussed as infrastrucutre assets may be inexpensive compared to Australia.