If you're trying to quantify the downside risk for our Big Four banks, the latest report from Morgan Stanley could supply a big piece of the puzzle and potentially fuel worries about a potential dividend cut!

The share prices of the Big Four – Commonwealth Bank of Australia (ASX: CBA), Westpac Banking Corporation (ASX: WBC), National Australia Bank Ltd. (ASX: NAB) and Australia and New Zealand Banking Group (ASX: ANZ) – have been under pressure for some time now as the broader S&P/ASX 200 (Index:^AXJO) (ASX:XJO) has moved ahead.

A softening property market, weak credit growth, pressure from the Banking Royal Commission and competition from non-bank lenders with more agile operations has created this no-to-low growth environment for Australia's biggest banks.

If these issues weren't enough, the proposed revision to the Australian Prudential Regulation Authority's (APRA) regulatory framework poses further downside risks to the sector, noted Morgan Stanley.

Buckling Banks: Average mortgage returns for the major banks

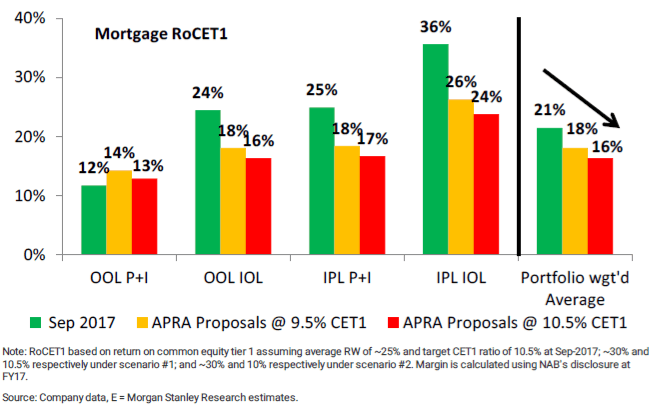

"We estimate that mortgage risk weights (RWs) could rise from ~25% in Sep-2017 to ~30%. All else equal, this would cause RoCET1 [the return on common equity tier-1 capital] to fall from ~21% to ~16% using a CET1 target of 10.5% or to ~18% using a CET1 target of 9.5%," said the broker.

"Our analysis suggests that the current return of ~21% is broadly in line with the early 2015 level, but there has been a significant change in returns for different types of loans."

The CET1 target is set by the banking regulator and is meant to ensure the banks have adequate liquidity to withstand loan defaults. APRA has lifted the target to 10.5% to ensure our banks are "unquestionably strong" mid last year.

The big four have increased the interest rate on some of their loans to protect margins but this has provided smaller lenders who do not need to comply with the CET1 target a chance to steal market share.

The big banks are now fighting back by cutting rates on some loans, such as interest-only mortgages, and that means they will have less ability to offset the substantial drop in RoCET1.

Try maintaining (let alone lifting) dividends payments on that!

Morgan Stanley isn't predicting a dividend cut but thinks the banks have further to de-rate. The broker is urging investors not to wait, and dump Commonwealth Bank and National Australia Bank shares now.

The broker warns that Commonwealth Bank's valuation looks full, especially in light of its declining return on equity, earnings hole from recent asset sales, further reputational damage from the Royal Commission and slowing home loan growth – which will impact more on Commonwealth Bank as it is the largest home loan lender in the country.

While National Australia Bank may have delivered good margin management, sound credit quality and cost discipline over the past year, Morgan Stanley thinks the low hanging fruits have been plucked.

This means the bank is facing rising execution risks as it looks to squeeze further operating efficiencies from the business.

"We see potential disappointment on revenue growth and little margin for error on loan losses, capital or the dividend," added the broker.

Morgan Stanley has a "neutral" rating on the other two big banks.

The good news is that there are attractive blue-chip buying opportunities outside the banks. The experts at the Motley Fool have nominated their top three favourite large cap stocks for 2018.

Click on the free link below to find out what these stocks are and why they are better bets than the banks.