The Nearmap Ltd (ASX: NEA) share price climbed after the release of its half year results this morning. Revenue grew 27% to $24.4 million while the loss after tax ballooned 120% to $6.5 million, compared to a loss of $2.9 million in the prior corresponding period.

Revenues grew via a combination of new subscribers (up 10%) and increased revenue per subscription (up 20%) which may be due to a combination of higher prices and upselling more features to existing subscribers.

Strong sales and marketing performance has led to Nearmap upgrading its full-year guidance. Nearmap expects to replicate its first half results by adding around $6.5 million in annualised contract value in the second half.

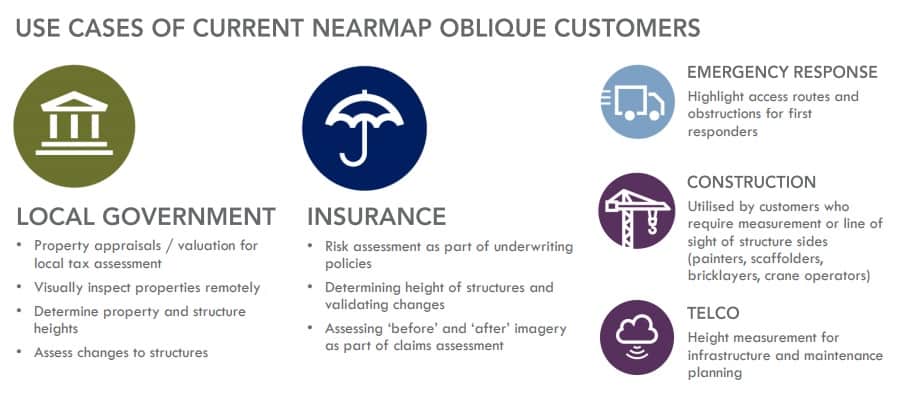

The company continues to launch new products, including its obliques suite, which allows side-view images of buildings, and 3D imagery. Both products will be launched to customers in the current financial year and are expected to become important drivers of revenues in the future.

One of the things I find surprising about Nearmap is the number of possible uses there appear to be for aerial imagery, with the company continually reporting new use cases:

On the downside, Nearmap continues to burn cash at a prodigious rate even as it moves closer to break-even on an operating level. If the company stopped purchasing plant & equipment, and stopped investing in new software, its cash burn rate would more than halve to just $3.3 million (currently $8 million).

That would obviously be counterproductive, but it does mean that Nearmap is likely to remain loss making until it can scale up further in the USA.

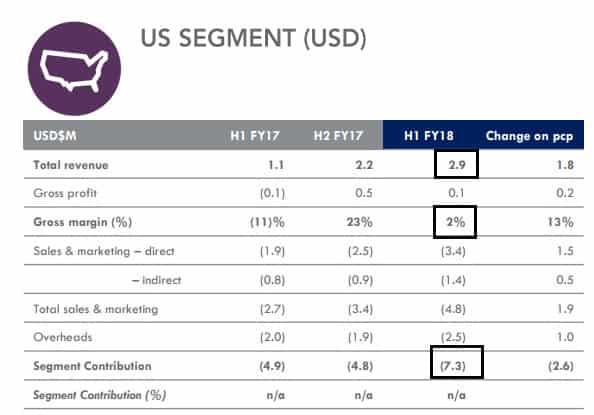

As you can see, the USA segment is still quite small in terms of revenue, and it is heavily loss making as a result – because the costs of administrating large swathes of territory are far larger than the revenues Nearmap currently earns here. However if Nearmap is able to continue growing revenues here, costs should prove relatively fixed and the company's financials should improve considerably. With $20 million cash in the bank, Nearmap is funded for another 18 months or so at the current burn rate.

I hold Nearmap and think that it is a promising prospect, however it is a high risk business and there's no certainty it will succeed in the USA. I would consider purchasing a small parcel at current prices with a view to topping up when the market gets discouraged with Nearmap, as it regularly does.