The Insurance Australia Group Ltd (ASX:IAG) ("IAG") share price rose 5.5% to $7.67 this morning after the company released bumper half year results.

Gross written premium (GWP) grew 0.6% to $5,802 million, while insurance profits jumped 30% to $687 million, resulting in 'cash net profit after tax (NPAT)' growing 31.5% to $479 million.

Like-for-like GWP growth was a staunch 4%, albeit impacted by discontinued business and a variety of regulatory reforms and currency impacts. Company profitability looks strong, however a large amount of this was due to lower-than-expected natural disaster claims.

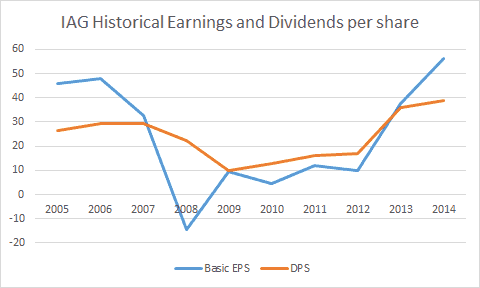

As we have noted previously, insurers typically have volatile earnings and this historical chart of IAG's earnings and dividends over the last decade is a case in point (I use the pre-2014 figures as they are much more volatile than in recent years). IAG's quota share arrangements – more on those below – should help smooth this out significantly:

Margins were flat compared to the first half last year, although IAG expects to see a meaningful financial benefit next year as its optimisation program continues. Management also struck several new reinsurance deals in the year, passing off an extra 12.5% of premiums and claims to Munich Re, Swiss Re, and Hannover Re.

These deals are broadly similar to the company's arrangement with Berkshire Hathaway, which is a 20% quota share arrangement. All told, IAG will now pass off a combined 32.5% of premiums and claims to its reinsurance partners. This reduces the company's financial risk and is expected to result in lower capital requirements and a 'broadly neutral' impact on earnings.

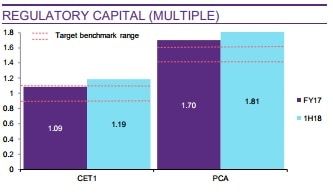

Speaking of regulatory capital, IAG is starting to see a build-up of excess capital on its balance sheet, with a further ~$400 million in benefits to come from the new reinsurance arrangements over the next 3 years.

All insurers have a 'prescribed capital amount' (PCA) which is the minimum amount they must have by law in order to operate as insurers (it's to ensure that there will be sufficient funds in the kitty to pay claims as they come due).

It's a lowball figure and most insurers operate with a significant margin of safety, which is why IAG's internal target benchmark is around 1.7x its prescribed capital amount. However with capital now at 1.8x PCA and climbing, IAG generally either has to start writing more insurance (to use that capital productively), or return capital to shareholders.

As the largest insurer in Australia I struggle to see IAG finding a productive use for its excess capital and the company has hinted it will return it to shareholders, likely via buybacks.

IAG's earnings per share grew 25% to 23.3 cents per share, and dividends were lifted 8% to 14 cents per share. At today's share price, IAG is priced at around 16x annualised earnings and pays a 3.8% dividend yield.