One of the worst performing stocks on the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) could deliver a better-than-expected profit result later this month.

I am referring to Domino's Pizza Enterprises Ltd. (ASX: DMP), which has seen its share price collapse by more than 20% over the past 12 months on a wage scandal and slowing sales.

Perhaps ironically, it's the worse-than-expected retail data that is fuelling the speculation on Domino's results.

Retail sales in December have fallen by more than double what analysts were expecting, no thanks to a collapse in household goods retailing.

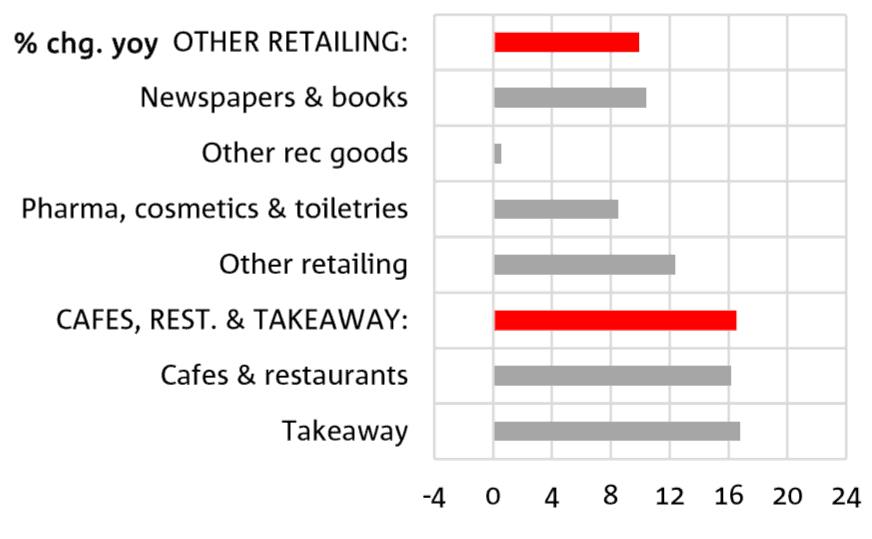

However, the monthly cashless retail sales index compiled by National Australia Bank Ltd. (ASX: NAB) showed that "Cafes, restaurants and takeaway" is the fastest-growing category with the takeaway component leading the charge.

NAB Cashless Retail Sales Index (December 2017)

Source: National Australia Bank

What's more, Morgan Stanley notes that online takeaway food sales growth was revised up to 14.7% from 12.9% and the broker believes the growth is driven by online aggregators like Menulog and UberEats, as well as a recovery in Domino's growth.

"Since Domino's market share is circa 40%, we think it is further evidence of a recovery in ANZ SSS [same store sales] growth – a key catalyst at the upcoming results on February 14," said Morgan Stanley.

"Today's launch of oven-baked sandwiches and king size pizzas is another example of Domino's improving its offer to drive its customer base, frequency and ticket."

The broker has reiterated its "overweight" recommendation on the stock with a price target of $60 a share.

I believe Domino's can redeem itself this year although ongoing wage negotiations with unions for local franchisees presents a risk. Management will also need to show it can return to growth in Australia and that its overseas expansion is paying off.

Other food retailers should also benefit from the robust growth in cafes, restaurants and takeaway. This includes embattled food franchisor Retail Food Group Limited (ASX: RFG) and fast food group Collins Foods Ltd (ASX: CKF), although I think the upside for these stocks is more limited.

There are other stocks that are also poised to do well in 2018. The experts at the Motley Fool are particularly bullish on a niche sector that they believe will have a big impact on investment markets this year and beyond.

Click on the link below to get your free report on this sector and to find out what are the stocks that are most likely to benefit from this investment thematic.