BT Investment Management Ltd (ASX: BTT) is the fund manager for the BT Wholesale MicroCap Opportunities Fund which has performed phenomenally over the last 5 years and beaten the market in the process.

The fund's philosophy takes the view that markets are not always rational and the inefficient market pricing of securities creates investment opportunities. This is particularly the case in micro caps where the sector is under-researched and sentiment will often drive periods of undervaluation and overvaluation.

Below is a review of the fund based on latest information:

- Fund size: $337 million

- Asset allocation: 94% Australian equities, 6% cash

- Investment style: Small cap growth stocks

- Fees: Management fee of 1.2% per annum (maximum) and performance fees of 1.8344% per annum.

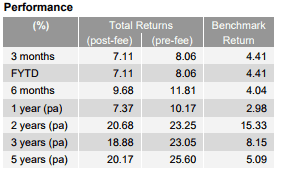

- Fund performance: The fund's performance is outlined below. The fund has outperformed its benchmark over the last 5 years with an annual gross return of 25.6% over the same period.

The key contributors to the fund's performance recently were:

- Hub24 Ltd (ASX: HUB). Its share price has been trading at all time highs on momentum gained since April when the company reported third-quarter inflows of $565 million. This took its retail funds under administration to $4.7 billion.

Foolish takeaway

Overall, whilst the fund's performance has been really good since inception, past performance is not an indication of future performance. If a fund is not what you are after and you would like to go for it alone, you might want to have a look at these three Aussie companies that are taking over the world.