The Thorn Group Ltd (ASX: TGA) share price is under selling pressure today — down 18% — but is it dirt cheap?

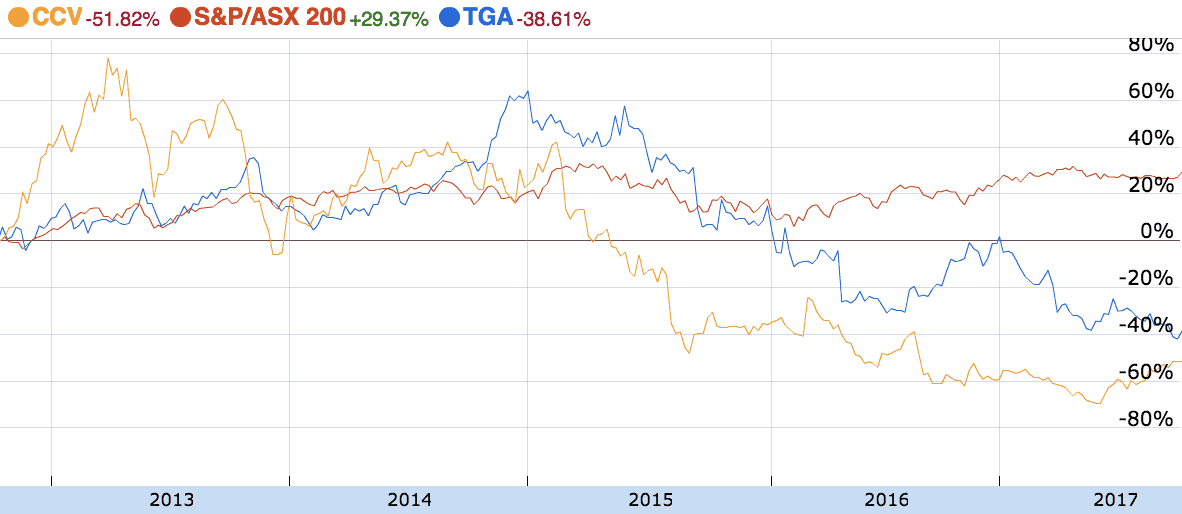

Thorn share price V. ASX 200

As can be seen above, shares in Thorn Group have significantly underperformed the S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) over the past five years. The same could be said of fellow short-term money lender Cash Converters International Ltd (ASX: CCV), which is down 52%.

Announcement

This morning, Thorn Group released a trading update to the market. In the release, it said subdued trading conditions and near-term corporate and legal uncertainties presented challenges for the business.

It said its profit for the full 2018 financial year would be between $17 million and $20 million, approximately 30% lower than last year.

"There continues to be a number of other variables which may have a material financial impact on Thorn's business and financial performance in the short to medium term," the company added. "These include the ongoing Australian Securities and Investment Commission investigation into Radio Rentals' responsible lending practices (for which Thorn Group has already made certain provisions) and the class action launched by Maurice Blackburn."

Maurice Blackburn has launched a class action seeking compensation for customers of Radio Rentals, which is the company responsible for the "Rent Try $1 Buy" campaign. Maurice Blackburn says, "The case alleges that Radio Rentals engaged in misleading or deceptive conduct and/or unconscionable conduct, and that Radio Rentals contracts contained unfair contract terms."

Thorn Group says that the weakness in performance is due mostly to Radio Rentals. However, its Business Finance operation continued to grow its receivables while the Consumer Finance operation continues to wind down its receivables book.

Balance sheet and dividends

Thorn Group also stated that its two banking facilities have been rolled over and an announcement about the amount of the half-year dividend will be made in November. Earlier this year, Thorn Group cuts its final dividend to 2.5 cents per share, from 6 cents per share last year.

Foolish Takeaway

Using the middle of Thorn Group's profit forecast, the company's shares change hands for around eight times their profit. That's a slight discount to Cash Converters and debt receivables business Collection House Ltd (ASX: CLH).

Although that may appear tempting — along with any fully franked dividends — personally, I would like to see a more compelling valuation before buying in. Nevertheless, I have Thorn Group shares on my watchlist.