I recently sold my shares in Retail Food Group Limited (ASX: RFG). The company has been a strong performer for me, although I obviously missed the lucrative opportunity to sell at $7 earlier this year.

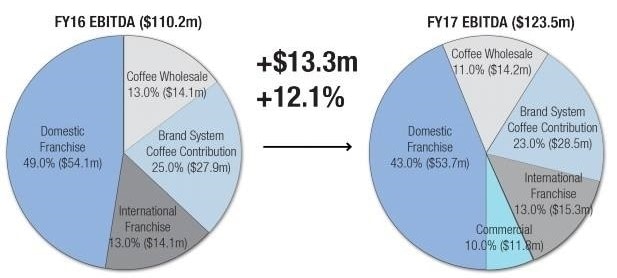

While there are several things that underpinned my decision to sell, the primary reason is encapsulated in this chart:

As you see in this chart, the majority of Retail Food Group's overall growth came from the acquisition of the Hudson Pacific bakery (the 'Commercial' segment). The Coffee Brand Systems segment grew just 2%, Coffee Wholesale sales were up 0.7%, International Franchise grew 20%, and Domestic Franchise earnings fell 0.8%. While this is just one year's results, it is not encouraging to see the core business (domestic franchise) going backwards at the same time as management is adding debt and issuing shares to buy new businesses.

I get uncomfortable when companies start to buy growth, especially given that I've previously felt that Retail Food has underinvested in its franchises, and also that the franchisee business model is under pressure from overly indebted Australian consumers. While I was previously optimistic about the Hudson Pacific acquisition, in a nutshell, I feel now that the risk has become too high for me, especially with the core business stagnant.

With a 6.9% fully franked dividend, and a growing international business, Retail Food Group doesn't have to achieve much of anything to be a market beater from here. However, I have now sold my shares, and will be looking for other opportunities.