Investors are attracted to small-cap shares because they usually come with greater growth prospects. To be sure, they are also more risky, but small companies are generally more likely to grow multiple times larger in a reasonable time frame than large companies.

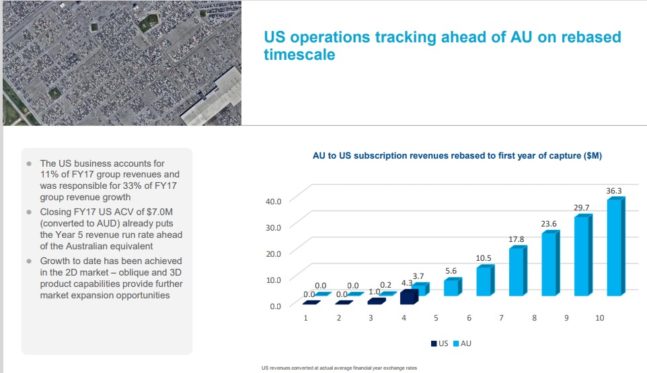

Nearmap Ltd (ASX: NEA) is one company that I think is capable of doubling in the next few years. It's a small aerial mapping company that is well established in Australia, and steadily expanding in the USA. Here's a chart showing its recent growth:

According to company estimates, Nearmap has around a 15% market share in Australia and less than 1% in the USA. While the USA operations are loss-making and require further investment next year, they are also growing sales rapidly and reflect a much larger potential market compared to Australia.

What's more, the Australian operations, growing rapidly and with huge 90% gross profit margins, would come close to justifying the company's market capitalisation on their own. Both businesses combined are cash-flow positive, although heavy investment in development continues to eat into the company's cash pile.

Still, Nearmap has $28 million in the bank which means it should be able to self-fund further development without further capital raises or taking on debt. The company's software solution is also scalable, meaning it doesn't cost a lot to add more customers – making growth very profitable.

Nearmap is a high-risk investment, with the greatest risk probably being competition in one form or another. This could either lead to higher customer turnover, much higher investment requirements, lower overall margins, and so on. Still, if the next 5 years look anything like the last 5, I think Nearmap would be comfortably worth twice as much as it is today.