Alcoa Corp (ASX: AAI) Share Price and News

Price

Movement

(20 mins delayed)

52 Week Range

-

1 Year Return

Alcoa Corp Chart and Price Data

Fundamentals Data provided by Morningstar.

Data provided by Morningstar.Share Price

Day Change

52 Week Range

-

Yesterday's Close

Today's Open

Days Range

-

Volume

Avg. Volume (1 month)

Turnover

as at 24 Feb 3:44pm

Alcoa Corp (ASX: AAI)

Latest News

Dividend Investing

4 ASX All Ords shares with ex-dividend dates next week

Share Market News

Here are the top 10 ASX 200 shares today

Share Gainers

Here are the top 10 ASX 200 shares today

Share Market News

Here's how the ASX 200 market sectors stacked up last week

Share Market News

Here are the top 10 ASX 200 shares today

Share Market News

Why did these 6 ASX 200 mining shares experience double-digit growth this week?

Dividend Payment History Data provided by Morningstar.

| Ex-Date | Amount | Franking | Type | Payable |

|---|---|---|---|---|

| 03 Nov 2025 | $0.1071 | 0.00% | Interim | 21 Nov 2025 |

| 11 Aug 2025 | $0.1086 | 0.00% | Interim | 28 Aug 2025 |

| 19 May 2025 | $0.1083 | 0.00% | Interim | 06 Jun 2025 |

| 03 Mar 2025 | $0.1113 | 0.00% | Final | 20 Mar 2025 |

| 28 Oct 2024 | $0.1060 | 0.00% | Interim | 15 Nov 2024 |

| 09 Aug 2024 | $0.1037 | 0.00% | Interim | 29 Aug 2024 |

| 05 May 2016 | $0.0276 | 0.00% | Interim | 25 May 2016 |

| 03 Feb 2016 | $0.0300 | 0.00% | Final | 25 Feb 2016 |

| 30 Jul 2010 | $0.0000 | 0.00% | Interim | 25 Aug 2010 |

| 03 May 2010 | $0.0000 | 0.00% | Interim | 25 May 2010 |

| 01 Feb 2010 | $0.0202 | 0.00% | Final | 25 Feb 2010 |

| 30 Oct 2009 | $0.0197 | 0.00% | Interim | 25 Nov 2009 |

| 31 Jul 2009 | $0.0219 | 0.00% | Interim | 25 Aug 2009 |

| 04 May 2009 | $0.0357 | 100.00% | Interim | 25 May 2009 |

| 02 Feb 2009 | $15.4522 | 0.00% | Final | 25 Feb 2009 |

| 04 Feb 2008 | $0.1651 | 0.00% | Final | 25 Feb 2008 |

| 29 Oct 2007 | $0.1613 | 100.00% | Interim | 25 Nov 2007 |

| 30 Jul 2007 | $0.1645 | 0.00% | Interim | 25 Aug 2007 |

AAI ASX Announcements

An announcement is considered as "Price Sensitive" if it is thought that it may have an impact on the price of the security.

| Date | Announcement | Price Sensitive? | Time | No. of Pages | File Size |

|---|---|---|---|---|---|

| YesNo |

About Alcoa Corp

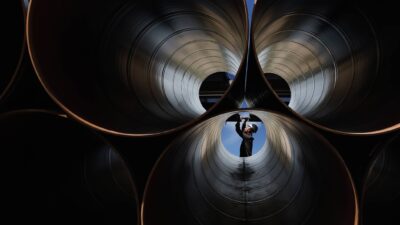

Alcoa is a vertically integrated aluminum company whose operations include bauxite mining, alumina refining, and manufacturing primary aluminum. It is one of the world's largest bauxite miners and alumina refiners by production volume, butsits outside the top-10 aluminum producers, a list dominated by Chinese companies. Profits are closely tied to prevailing commodity prices along the aluminum supply chain.Alcoa was the first mass producer of aluminum, launching the world-changing Hall-Heroult smelting process in the 1880s, making aluminum affordable. It listed as a public company in 1925. In 2016, Alcoa spun off its automotive and aerospace metal parts segment to focus on mining, smelting, and refining. It bought the 40% unowned balance of AWAC in mid-2024.

AAI Share Price History Data provided by Morningstar.

| Date | Close | Change | % Change | Volume | Open | High | Low |

|---|---|---|---|---|---|---|---|

| 02 Feb 2026 | $81.57 | $-2.70 | -3.20% | 180,151 | $81.74 | $82.35 | $80.29 |

| 30 Jan 2026 | $84.27 | $-3.47 | -3.95% | 106,447 | $85.85 | $87.01 | $83.19 |

| 29 Jan 2026 | $87.74 | $0.51 | 0.58% | 196,018 | $85.89 | $87.74 | $84.54 |

| 28 Jan 2026 | $87.23 | $2.60 | 3.07% | 177,165 | $84.80 | $87.70 | $84.80 |

| 27 Jan 2026 | $84.63 | $-8.22 | -8.85% | 293,316 | $84.99 | $85.46 | $82.25 |

| 23 Jan 2026 | $92.85 | $-0.76 | -0.81% | 343,032 | $93.61 | $93.69 | $91.51 |

| 22 Jan 2026 | $93.61 | $1.00 | 1.08% | 96,780 | $94.09 | $95.22 | $93.61 |

| 21 Jan 2026 | $92.61 | $4.03 | 4.55% | 165,485 | $91.43 | $92.83 | $91.43 |

| 20 Jan 2026 | $88.58 | $-1.72 | -1.90% | 99,932 | $89.39 | $89.88 | $88.37 |

| 19 Jan 2026 | $90.30 | $-4.98 | -5.23% | 191,412 | $89.22 | $90.47 | $88.64 |

| 16 Jan 2026 | $95.28 | $-0.62 | -0.65% | 140,055 | $94.75 | $95.89 | $94.75 |

| 15 Jan 2026 | $95.90 | $-1.65 | -1.69% | 744,157 | $96.98 | $97.46 | $95.90 |

| 14 Jan 2026 | $97.55 | $0.51 | 0.53% | 312,906 | $97.39 | $98.25 | $97.39 |

| 13 Jan 2026 | $97.04 | $2.29 | 2.42% | 201,257 | $97.65 | $98.32 | $97.04 |

| 12 Jan 2026 | $94.75 | $3.53 | 3.87% | 491,572 | $94.20 | $95.50 | $93.85 |

| 09 Jan 2026 | $91.22 | $-1.31 | -1.42% | 379,361 | $90.30 | $91.22 | $89.83 |

| 08 Jan 2026 | $92.53 | $0.19 | 0.21% | 707,956 | $92.00 | $93.35 | $91.85 |

| 07 Jan 2026 | $92.34 | $1.87 | 2.07% | 801,814 | $93.89 | $94.31 | $92.34 |

| 06 Jan 2026 | $90.47 | $5.87 | 6.94% | 475,632 | $91.00 | $91.50 | $90.14 |

Director Transactions Data provided by Morningstar.

| Date | Director | Type | Amount | Value | Notes |

|---|---|---|---|---|---|

| 12 May 2025 | Ernesto Zedillo | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | John Bevan | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | Thomas Gorman | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | Carol Roberts | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | Alistair Field | Buy | 5,690 | $232,948 |

As advised by the company. As per announcement on 12/05/2025

|

| 12 May 2025 | Pasquale Fiore | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | Roberto Marques | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | Jackson Roberts | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

| 12 May 2025 | Mary Citrino | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 05/12/2025

|

| 12 May 2025 | James Hughes | Buy | 5,690 | $232,948 |

As advised by the company. as per announcement on 12/05/2025

|

Directors & Management Data provided by Morningstar.

| Name | Title | Start Date | Profile |

|---|---|---|---|

| Dr Ernesto Zedillo | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Mr John Andrew Bevan | Non-Executive Director | Aug 2024 |

No Profile Reported in Annual Report

|

| Mr Thomas Joseph Gorman | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Ms Carol L Roberts | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Mr Alistair Field | Non-Executive Director | Aug 2024 |

No Profile Reported in Annual Report

|

| Mr Pasquale Fiore | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Mr William F Oplinger | Chief Executive OfficerExecutive DirectorPresident |

No Profile Reported in Annual Report

|

|

| Mr Steven W Williams | Non-Executive ChairmanNon-Executive Director |

No Profile Reported in Annual Report

|

|

| Mr Roberto O Marques | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Mr Jackson P Roberts | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Ms Mary Anne Citrino | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| James A Hughes | Non-Executive Director |

No Profile Reported in Annual Report

|

|

| Molly S. Beerman | Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

-

|

|

| Renee R. Henry | Senior Vice President and Controller (Principal Accounting Officer) |

-

|

Top Shareholders Data provided by Morningstar.

| Name | Shares | Capital |

|---|---|---|

| No Top 20 Shareholder | 0 | 0.00% |