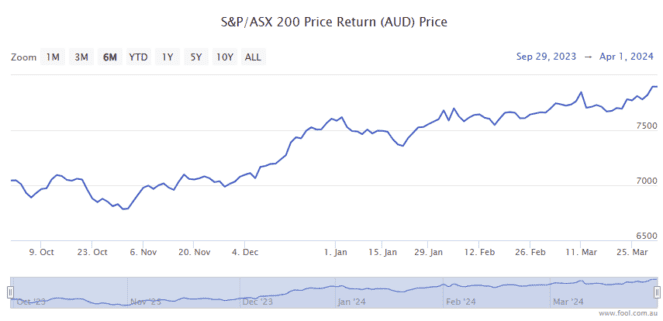

S&P/ASX 200 Index (ASX: XJO) investors were treated to a series of record-breaking highs in March.

The month just past saw the Aussie benchmark index set a series of new intraday highs as well as a number of fresh record-closing highs.

March started in good form, with the ASX 200 setting a new intraday high of 7745.6 points on Friday, 1 March.

And after breaking records throughout the month, March ended on another bang with the index hitting a new intraday high of 7901.2 and finishing at a new closing high of 7896.9 points.

That sees the index of the top 200 listed Aussie stocks up 2.6% for the past month and up a whopping 16.5% since 31 October.

Investors looking to mirror this performance could consider buying into all 200 companies.

Or they may wish to consider investing in a single stock that has been successful at closely tracking the returns of the ASX 200.

What's been driving the ASX 200 to new record highs?

Investors have been piling back into the Aussie stock market in line with bullish animal spirits in the United States' markets. That enthusiasm also saw the S&P 500 Index (SP: .INX) notch a series of new record highs in March.

The ASX 200 has been getting its own lift as inflation begins to fall back towards the RBA's target range, bolstering the odds for interest rate cuts in 2024.

Company earnings have also held up strongly despite some macroeconomic headwinds.

And there are signs that China's economy may be set for a rebound following a year of tepid growth. That could offer a big boost for Aussie companies focused on exports.

One stock to track the top 200

The stock in question is the BetaShares Australia 200 ETF (ASX: A200).

The exchange-traded fund (ETF) aims to track the performance of the ASX 200. And it's been doing just that.

Since 31 October the ASX 200 has gained 17.9%, slightly outpacing the gains of the benchmark index.

A200 also pay quarterly dividends, partly franked. The ETF currently trades on a trailing yield of 3.6%.

Its top three holdings are BHP Group Ltd (ASX: BHP), Commonwealth Bank of Australia (ASX: CBA) and CSL Ltd (ASX: CSL). As you'd expect these also count among the biggest listed companies in Australia.

Importantly, as fees can take a sizable bite out of your returns, the ASX ETF also comes with a very low annual fee of 0.04%.

As always, if you'd rather buy individual stocks that could outperform the benchmark, make sure to do your own thorough research first.

If you're not comfortable with that or are short on time, then simply reach out for some expert advice.