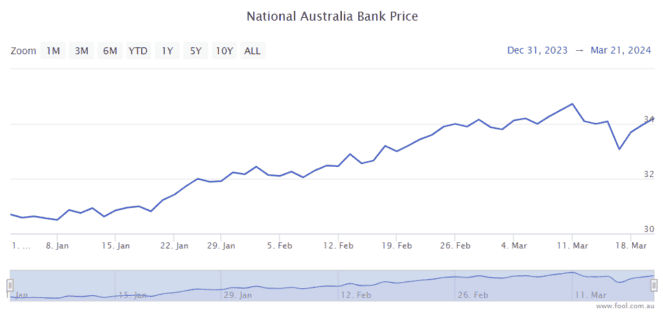

National Australia Bank Ltd (ASX: NAB) shares have performed well for shareholders in 2024 to date. The NAB share price has climbed around 13% in the year so far. That compares to a rise of just 2% for the S&P/ASX 200 Index (ASX: XJO).

In this article, we're going to look at how a $5,000 investment in NAB shares would have grown.

Good returns

The NAB share price finished 2023 at $30.70, so with $5,000 an investor would have been able to buy 162 shares (with a little bit of cash leftover).

As I've already mentioned, the NAB share price has gone up by 13%, so those 162 shares would now be worth $5,634.36 (at the time of writing).

Seeing as we're only a few months into the year, we haven't seen NAB pay a dividend yet.

If NAB were to pay the same dividends over the next 12 months as the last 12 months, it could pay an annual dividend per share of $1.67. At the current valuation, that translates into a cash dividend yield of 4.8% or a grossed-up dividend yield of 6.9%.

If the NAB share price were to end 2024 at $34.78, the total shareholder return (which is dividends plus capital growth) would be close to 18%. I think that would be a market-beating performance.

What's driving the NAB share price?

To get the true answer, you'd need to go and ask each buyer of NAB shares in the last few weeks about why they were willing to pay a higher price.

Overall, the wider economic conditions are helpful for NAB. The unemployment rate remains low, inflation is reducing and interest rates are seemingly getting closer.

However, the recent FY24 first-quarter update wasn't the most positive. It reported it generated $1.7 billion of statutory net profit after tax (NPAT) and $1.8 billion of cash earnings. The cash earnings were down 16.9% year over year.

NAB talked about a slightly underlying net interest margin (NIM) because of higher deposit costs and competitive lending pressures, mostly relating to Australian home lending.

It also reported a credit impairment charge was $193 million reflecting higher arrears in Australian home lending combined with business lending volume growth. The ratio of loans that were at least 90 days overdue was 0.75% at the end of the FY24 first quarter, up from 0.62% in the first quarter of FY23.

Time will tell whether the run-up of the NAB share price is justified or not amid the rising arrears.