The Federal Court has approved a travel order against the suspended chief of an ASX-listed technology company to prevent him from leaving the country.

The Australian Securities and Investments Commission this week submitted an application to stop Dubber Corporation Limited (ASX: DUB) chief executive and managing director Stephen McGovern exiting Australia while it conducts an investigation.

The order also prevents Christopher William Legal solicitor and principal Mark Madafferi from leaving the country.

ASIC investigating ASX CEO over missing funds

Dubber shares were placed in a trading halt on 27 February, and have been frozen ever since.

The company then reported to ASIC that McGovern was suspended as managing director and chief executive and the reasons why it took that action.

On March 1, the corporate watchdog started investigating the suspicions that funds in a term deposit belonging to Dubber and one of its subsidiaries had been misused.

The deposits were allegedly held in trust by Madafferi.

According to ASIC, $26.6 million remains unaccounted for and it has "concerns" that McGovern and Madafferi may have breached the Corporations Act.

The travel order hearing was held with both men absent.

McGovern is a UK national while Madafferi is an Australian citizen.

The matter will be heard again in court on Wednesday.

What has Dubber been doing?

Dubber operates a cloud telecommunications platform for corporate clients.

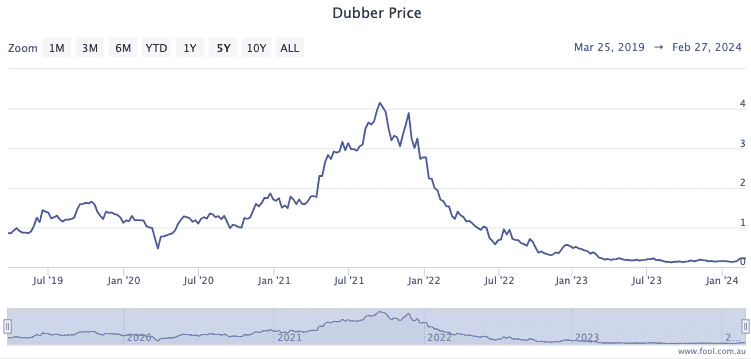

In 2021, the share price flew above the $4 mark, but at the time of the trading halt last month it was languishing at 22 cents.

Despite the term deposit scandal, Dubber announced last week that it had secured a $5 million loan from Thorney Investment Group.

"Unquestionably we were shocked by Dubber's recent announcement," Thorney Investment Group executive chair Alex Waislitz said.

"Notwithstanding, Thorney continues to believe Dubber has sound prospects having built a substantial global client base that includes many Tier 1 communications service providers."