There are so many delightful ASX dividend shares out there that can help you generate a decent flow of passive income.

That payment stream could even be your ticket to an early retirement, if you manage it well.

The reason why the ASX is endowed with so many excellent income producers is because of franking credits.

The concept allows beneficiaries to avoid paying income tax on dividends from company profits that have already had corporate tax paid.

This incentivises ASX businesses to use dividends rather than buybacks as the method of returning capital.

So if you want to start establishing a strong source of passive income today, there is one stock that I'm intrigued by:

The real deal passive income generator

Yancoal Australia Ltd (ASX: YAL), for the last couple of years, has been famous as that weird stock viewed with suspicion at the top of ASX dividend yield league tables.

At one stage its yield was almost touching 20%.

This nosebleed level of payouts combined with the volatile nature of energy and resources stocks meant the scepticism was probably well justified.

But now, after the latest payout, that figure is down to a more sane — but still juicy — 12.8%.

That's the equivalent of $12,800 of annual passive income from a $100,000 portfolio.

Pretty sensational.

And with the global economy looking forward to a revival over the coming years, experts are liking the outlook for the coal producer. The better the health of the economy, the higher the energy demand, and this pushes the coal price upwards.

In fact, all four analysts surveyed on broking platform CMC Invest say Yancoal is a buy right now.

The company enjoyed a decent reporting season, when chief executive David Moult indicated in 2023 it met the target of rebuilding mining inventory, with production increased every quarter.

"The group is in a robust financial position, with no external loans, $1.8 billion of franking credits available, and a net cash balance that we expect will increase each month."

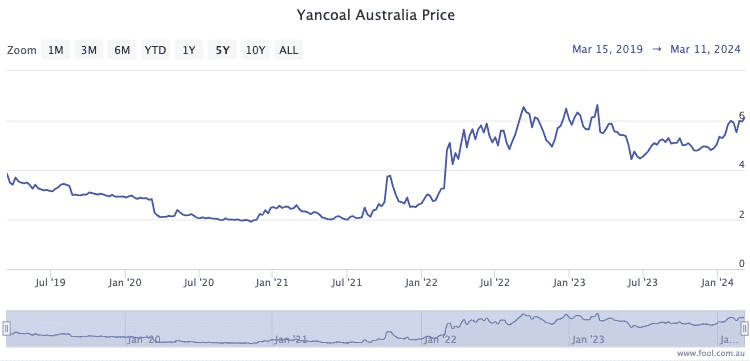

In the long run, the Yancoal share price has gained 46% over the past five years.