It's a big call to say any ASX stock is a "must own", but certainly there are some compelling shares out there worth consideration right now.

One that I think is a great candidate at the moment is US software maker Life360 Inc (ASX: 360).

The stock is on an absolute tear right now, rising a jaw-dropping 64% this year.

So what's doing here?

Responding to market concerns

A couple of years ago, when technology and ASX growth shares were plunging from inflation fears, the management at Life360 decided to change the way it operated.

The team responded to market concerns and decided to burn less cash and focus on profitability.

The turnaround was appreciated by investors, with the latest yearly result released this month proving the climax so far.

"The highlight of the result was arguably Life360's adjusted EBITDA. It was US$20.6 million for the year, which was comfortably ahead of its guidance range of US$12 million to US$16 million," reported The Motley Fool's James Mickleboro.

"While the company recorded a net loss of US$28.2 million, this was a massive US$63.5 million improvement from FY 2022."

From its trough in June 2022, the Life360 share price has multiplied almost five times.

Amazing.

I'm not alone in my bullishness for Life360 stock

But of course, there is no point in buying these shares now if they've already had their run.

The great news for punters is that it may not be too late to grab a piece of Life360.

Seven out of eight analysts currently surveyed on CMC Invest are maintaining a strong buy rating for the tech stock.

The team at Goldman Sachs Group Inc (NYSE: GS) recently upgraded its share price target for Life360.

"The company is now scaling margins and earnings rapidly off a low base, with attractive unit economics and potential structural profitability tailwinds on the horizon from a reduction in effective app store fees."

Life360 has flagged the possibility of introducing advertising into its popular smartphone app, which the Goldman Sachs analysts thought was an excellent idea.

"Given our long-held view that Life360's subscription business remains undervalued, we view the potential advertising upside as effectively a 'free' option."

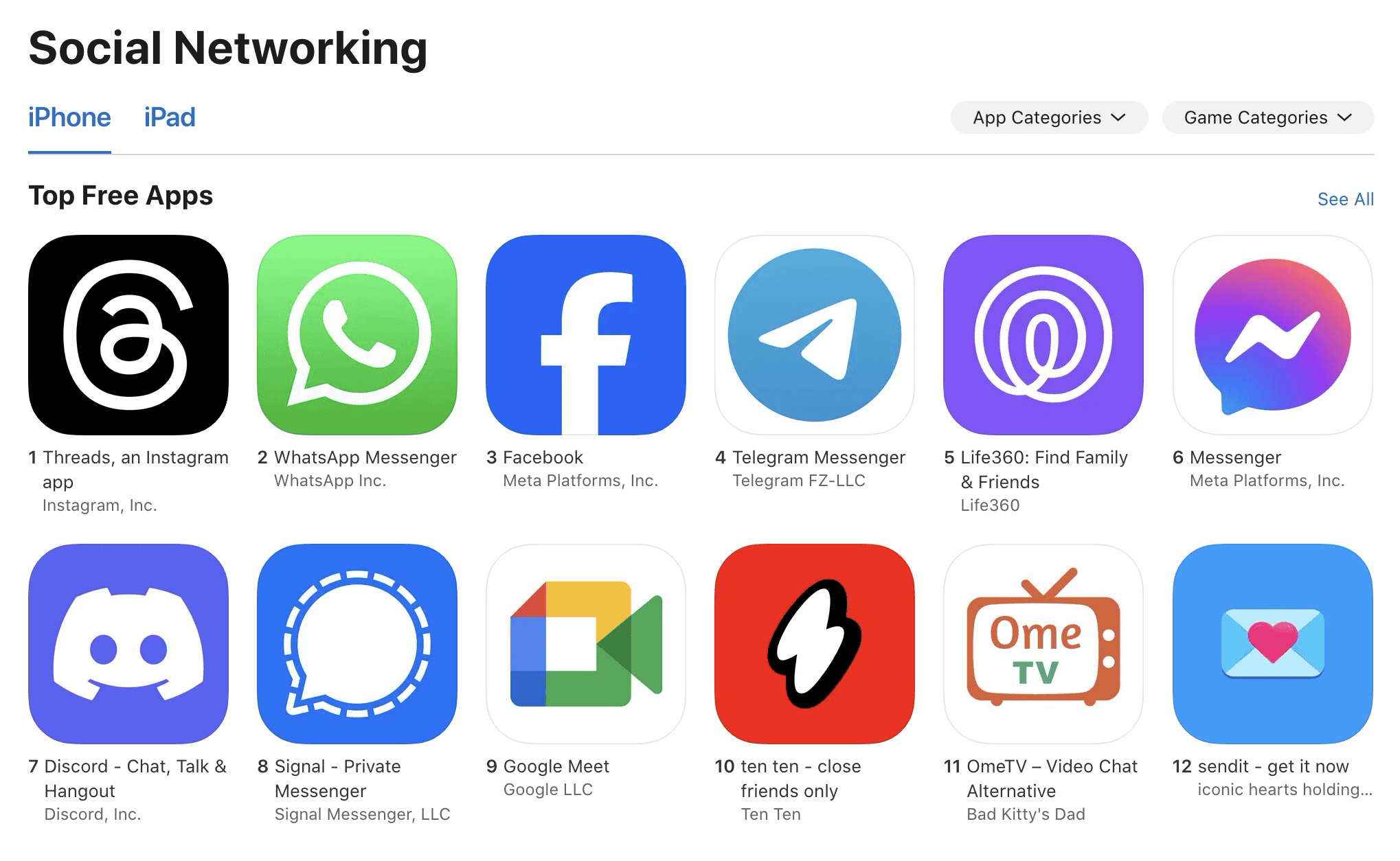

The app is now ranked 30th in the iPhone app store, and 5th in the social networking category.

"Life360's subscription business currently trades at a discount to global subscription app peers when adjusting for its superior growth outlook."