ASX 200 property share Goodman Group (ASX: GMG) is trading 0.58% lower on Friday at $30.79.

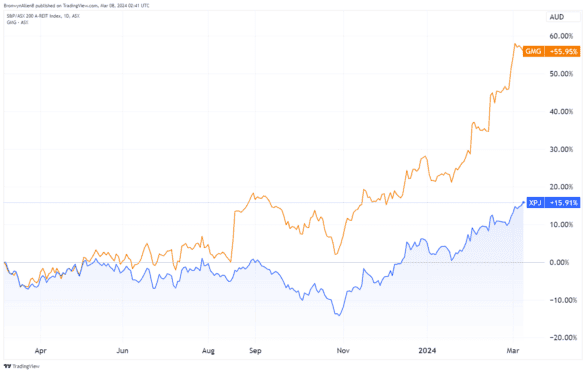

The industrial property specialist has been on a tear over the past year, up 56%, in fact.

This compares to its peers in the S&P/ASX 200 A-REIT Index (ASX: XPJ), which are trading 16% higher over the same period.

So, why is the Goodman share price growing at nearly quadruple the rate of other ASX 200 real estate stocks?

Go, you good thing!

Goodman Group is the biggest real estate investment trust (REIT) on the ASX 200 with a $58.8 billion market capitalisation.

Last year, it was one of the top five most profitable large-cap ASX 200 shares.

The ASX REIT released its 1H FY24 results last month. Goodman Group reported a 29% year-over-year increase in operating profit to $1.13 billion. This was higher than it had expected and resulted in a FY24 guidance upgrade.

The ASX 200 share rose 7% on the news. So, investors are feeling pretty happy right now.

Why is Goodman outperforming its peers by so much?

Well, one factor is likely its key point of difference in owning and managing many industrial property assets.

Industrial is hot property

Large warehouses and the like are in high demand today due to the expanding digital economy.

And the growth in artificial intelligence is adding fuel to the fire.

Online retailers and cloud computing companies are among the major commercial customers competing fiercely for large industrial properties like the ones Goodman owns.

Industrial property is in short supply nationally, which gives Goodman two major opportunities.

It can maximise its rental returns, with like-for-like net property income (NPI) growth coming in at 5% and portfolio occupancy remaining high at 98.4%.

It also has the money to buy more existing warehouses or the land to build them on.

Goodman has 85 projects in the development pipeline worth a collective $12.9 billion. Data centres make up 37% of the pipeline. The forecast yield on cost is 6.7%.

CEO Greg Goodman reckons cap rates for prime assets are currently attractive, making the group "focused on the buying opportunity".

Goodman's total assets under management are now worth $79 billion, down 2% from 30 June 2023.

What's ahead for Goodman Group?

Commenting on the outlook, CEO Greg Goodman said:

Our focus on providing the essential infrastructure for the digital economy is supporting the positive

outlook for FY24. Data centres will be a key area of growth and the acceleration of data centre activity is a catalyst for the Group to consider multiple opportunities to enhance its returns.Given positive structural trends, we expect continued customer and investor demand for our high quality industrial and digital infrastructure assets. Supply constraints in our locations are expected to continue to drive rental growth and maintain high occupancy rates across the portfolio.

ASX 200 share price snapshot

This ASX 200 property share has gained 131% in market capitalisation over the past five years.

This compares to 7.3% for the S&P/ASX 200 A-REIT Index.