We've all been there once.

It's a scary step to invest in stocks for the first time. You've yet to experience the ups and downs first-hand, so it's hard to know whether you're doing the right thing.

If you're in this spot, I want to try to make that first step a tad easier.

Here are two ASX shares that I'd start a blank portfolio with:

A balance between risk and reward

Xero Ltd (ASX: XRO) is an oldie but a goodie for beginners.

It's a well-established $20 billion company now, but still has much room to grow. So I feel like the S&P/ASX 200 Index (ASX: XJO) stock is a nice balance between risk and reward for those taking the plunge for the first time.

Despite some major shocks over the past five years, such as COVID-19 and steeply rising interest rates, Xero shares have managed to gain a tidy 172%.

The New Zealand business has shown it can adapt to changing conditions. Last year, a new chief executive was brought on to pivot Xero from a cash-burning technology startup to one that's more focused on positive cash flow.

And the market has warmed to that new philosophy, sending the Xero share price 69% upwards over the past 12 months.

Even after that, nine out of 12 experts currently surveyed on broking platform CMC Invest are still recommending the stock as a buy.

The ASX shares that aren't really an investment in shares

Maybe you are investing in shares to get away from unaffordable Australian real estate, but there's a way to have your cake and eat it too.

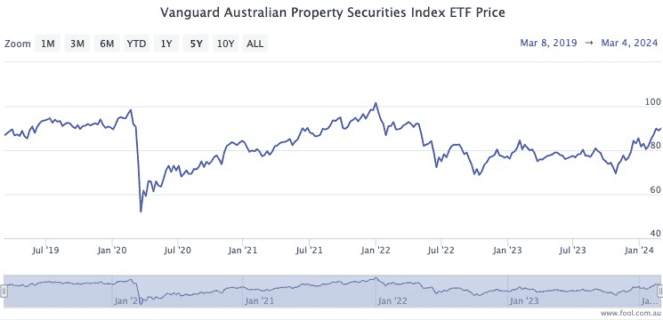

Vanguard Australian Property Securities Index ETF (ASX: VAP) is an exchange-traded fund (ETF) that replicates the constituency of the S&P/ASX 300 A-REIT Index.

That index, in turn, represents the real estate investment trusts (REITs) from the 300 biggest companies on the ASX.

With the prospect of stability and even a cut in interest rates, the property market is already buoyant, sending the VAP share price 32% higher since late October.

But the fact remains the ETF is still more than 30% down from its 2021 peak. And we all know how much Aussies love real estate.

VAP also hands out quarterly distributions, which currently stand at around 3.4% yield.