The trouble with ASX income stocks with high dividend yields is that there could be a catch.

It could be that the business prospects are in decline, and either the share price or the dividend itself could be headed southwards.

But occasionally you come across a gem.

The ASX income stock with 11.9% yield after cutting dividend

Yancoal Australia Ltd (ASX: YAL) has coal mining assets in NSW, Queensland, and Western Australia.

Over the last couple of years, it has become famous as one of the most generous dividend payers on the ASX.

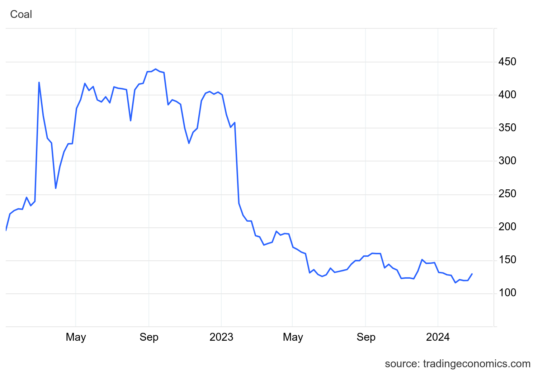

As Russia invaded Ukraine in 2022, energy prices soared around the world. However, 2023 wasn't quite as lucrative as the market settled back to normality.

So the news out of reporting season was that Yancoal would cut its latest distribution by more than a half compared to a year ago.

Incredibly though, the dividend yield still remains at a more-than-respectable 11.9%, fully franked.

Production and macroeconomics looking good

"But what about the outlook though?" the savvy investors would ask.

The company reported that last year it achieved its goal of rebuilding mining inventory, having increased production in each and every quarter.

And chief executive David Moult expects the business to continue this "operational momentum" into the coming year.

"The group is in a robust financial position, with no external loans, $1.8 billion of franking credits available, and a net cash balance that we expect will increase each month."

According to TradingEconomics, China's coal imports last month were 34% higher than a year prior, while Japan and South Korea are both experiencing "strong demand" for thermal coal.

This is why, despite the phenomenal dividend yield, I reckon Yancoal is a buy at the moment.

The experts agree, with all four analysts covering the stock classifying it as a buy, as surveyed on CMC Invest.