It's been well documented that the last 12 months have been no picnic for ASX lithium shares.

With Western economies deliberately slowed via rising interest rates and Chinese consumers reluctant to shell out for major purchases like electric cars, demand has nosedived.

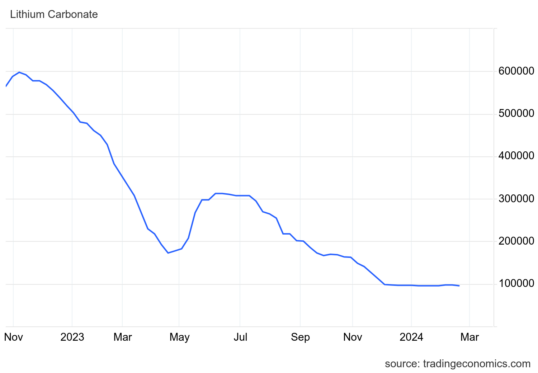

The brutal fact is that a tonne of lithium carbonate was selling for almost 600,000 CNY in November 2022, and now no one will even buy it for six figures.

Ouch.

However, many experts are still expressing long-term bullishness for the commodity.

Their argument, which I agree with, is that batteries are too important in the global transition to net zero carbon emissions. There are simply too many cars and other machinery that will need to switch from burning fossil fuels to using electricity.

So that reasoning extended to lithium stocks. Buy now while they're cheap and watch them rise as demand eventually picks up.

But is it as simple as that?

I would say that there are some better purchases among ASX lithium shares right now than others.

Let's take a look at Core Lithium Ltd (ASX: CXO), for example.

When a lithium miner stops mining lithium

Many of the large mining companies, with economies of scale and even other minerals to depend on, have kept producing lithium despite the current low price.

But with a market cap of just $453 million, Core Lithium is not one of them.

And the consequence is that last month it was forced to stop mining.

This is an economically responsible decision, for sure. But it doesn't leave much hope for investors who own shares at the moment.

As such, Core Lithium shares remain one of the highest shorted stocks on the ASX. The last report was that a whopping 13% were borrowed for shorting.

Professional investors' ratings support this bearishness.

Broking platform CMC Invest currently shows none of the nine analysts that cover Core Lithium rating it as a buy. In fact, seven of them are urging investors to sell.

And that's why I'm crossing the street to avoid Core Lithium shares.

For now.