Many punters would be surprised at how few shares you need to potentially generate regular passive income.

Is the prospect of an extra $1,500 each month tempting enough for you to try investing?

While diversification is imperative in every portfolio, to demonstrate how achievable the above goal is, let me pick out one particular S&P/ASX 200 Index (ASX: XJO) stock.

What does Goodman Group do?

Goodman Group (ASX: GMG) is a developer and manager of industrial real estate.

That might not sound all that exciting on face value. But the continuing transition of retail from bricks-and-mortar to online has been a goldmine for Goodman.

The retail sector is increasingly needing the type of warehouse and industrial park properties to be able to execute e-commerce capabilities.

In fact, US behemoth Amazon.com Inc (NASDAQ: AMZN) is a tenant of Goodman's.

And to further fuel growth, Goodman is starting to develop properties for data centres, which are crucial for cloud computing and artificial intelligence.

How is Goodman Group going?

Last Thursday alone Goodman shares rocketed 6.5% at one stage, after it revealed boom results that morning.

The company showed off a 98.4% occupancy rate, 29% increase in operating profit and available liquidity of $3 billion.

Goodman Group has $12.9 billion of development in progress across 85 different projects.

Chief executive Greg Goodman said its well-located real estate was allowing tenants to "increase investments in digitisation and automation to improve efficiency".

"Our growth in data centre capacity underscores our ability to deliver digital infrastructure, where we're securing power on our sites and developing data centres in cities with high demand."

$40,000 and six years: all you need for passive income

So that's all good, but how can Goodman shares generate passive income for you?

Let's say you bought $40,000 worth of stock right now, which equates to about 1,400 shares at the current price.

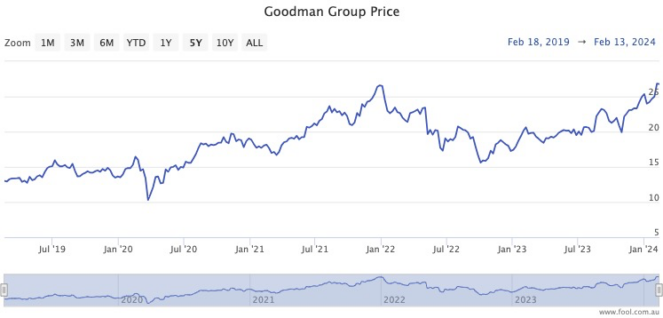

While past performance is no indicator of the future, for the purposes of this hypothetical, let's look back at the five-year track record.

The Goodman share price has gained 119%, excluding dividends, which equates to a compound annual growth rate (CAGR) of just under 17%.

Because the stock pays out a small dividend each year, let's round it up to 17% for ease of calculation.

That $40,000, if you allow it to grow at 17% per annum compounded monthly, will reach $110,136 after just six years.

From that point on, instead of keeping the returns and dividends in the investment, just cash out.

The 17% would provide you with an average passive income of $18,723 each year.

And that's a monthly payout of $1,560.

Done.