It's fair to say that ASX healthcare shares have flummoxed investors over the past couple of years.

As interest rates headed up and consumers closed their wallets, many fund managers expected the health sector to outperform because of their defensive nature.

Perhaps because of the unusual nature of the current downturn with consumers having a massive savings buffer from COVID-19, that thesis never really played out.

But now, as the prospect of rate cuts becomes tantalisingly close, there seems to be a light at the end of the tunnel for long-struggling healthcare shares.

"We've got a couple of key holdings in the portfolio in small-cap healthcare," QV Equities portfolio manager Marc Whittaker said in a video blog.

"That's a sector that I'm really excited about. Valuations are really compelling."

So if you're looking for cheap health stocks to pick up right now before they shoot up, these are the ones QVE team is backing:

'Excited' for a return to business-as-usual

With a $600 million market cap, Australian Clinical Labs Ltd (ASX: ACL) is the third largest pathology services provider in the nation, according to Whittaker.

"Pathology is a great sector," he said.

"It's really about volume… You run your laboratory, largely across a fixed-cost network. And the more volume you can put through your laboratory network, the higher your operating leverage, the higher your scale, efficiencies, and so on."

After a 43% drop in the share price since August 2022, his team is "excited" about Australian Clinical Labs' prospects.

"Top line's growing at around 5% to 6%, and that's roughly in line with what we think the long term average is for the sector. So that's been encouraging."

After the surge in COVID-19 testing a couple of years ago, the environment and financial metrics are starting to recover back to normal.

"On the margin side, or the cost side, things are still washing through a little bit."

GP shortage is rapidly being addressed

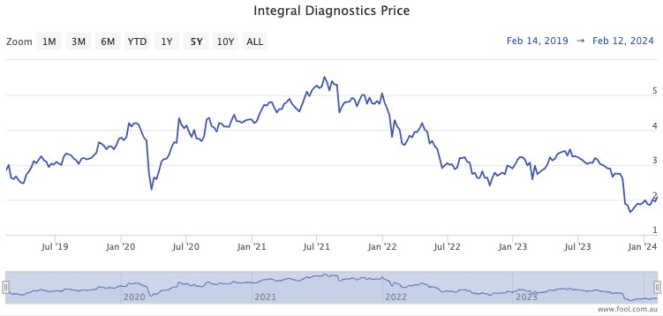

The post-pandemic story is similar with diagnostic imaging provider Integral Diagnostics Ltd (ASX: IDX), with the stock losing more than half its value since April 2022.

The problem for both businesses, according to Whittaker, is that there is "a bottleneck when it comes to GP visitation".

"Whether that's because people are still loathe to get back to the GP after the COVID experience and/or the fact there's a bit of a shortage in GPs at the moment.

"We've had a controlled immigration intake for quite some time, and that really means a lot of GPs we rely on [who] come from offshore haven't been arriving."

But that inflow of foreign doctors is starting to now recover, and will be a tailwind for Integral Diagnostics.

"Top line's doing okay, costs just need to start normalising a little bit," said Whittaker.

"That top line should be enhanced by these GP visitations as they improve over time."

The healthcare shares backed by irresistible themes

He added that both Integral and ACL, in the long run, have the demographic trend of an ageing population in their favour.

"Both are compounders in my view, so longer term, we expect them to keep delivering."

QVE senior portfolio manager Simon Conn likes that both companies also have scope to improve efficiencies.

"One of the things I like about the sector is the technology — pathology and radiology, both benefiting from technology," he said.

"So the ability to diagnose more things with pathology tests and radiology scans is really seeing the amount of work that these businesses do grow over time."