I think the ASX healthcare stock Sonic Healthcare Ltd (ASX: SHL) looks very undervalued. It's so cheap that I'm thinking about buying some Sonic Healthcare shares myself.

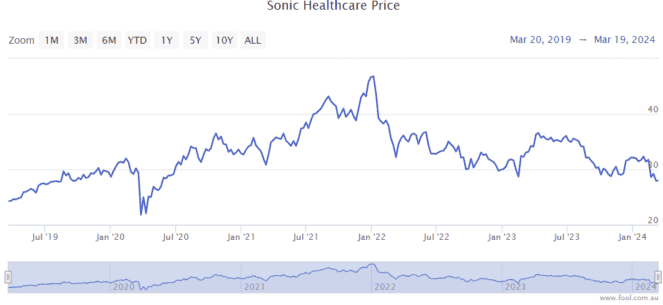

The Sonic Healthcare share price has fallen more than 15% in the past year and it's down around 25% since April 2023.

This global pathology business is one to look into, in my opinion.

I love investing in growing businesses where the share price has dropped because this means the price/earnings (P/E) ratio has reduced and is usually more attractive.

Multiple growth avenues

COVID-19 testing revenue has almost entirely gone, which has reduced the company's operating leverage.

But, the FY24 first-half result demonstrated a number of the positives that I like about the business.

For starters, it reported base business revenue growth (which excludes COVID-19 testing) of 15%. Its organic revenue growth was 6.2% (which excludes things like acquisitions), which is a solid core business growth rate.

The base business is benefiting from different tailwinds, like a growing population, which means there are more potential patients, while an older population could increase the frequency that services are required.

Sonic Healthcare is regularly investing in making new acquisitions, which can boost its scale – this can increase the profit margins. Around A$500 million of new annual revenue has been secured from acquisitions and contract wins, including $175 million from Synlab Suisse and $265 million from German acquisitions.

The ASX healthcare stock also said its cost reduction programs are "well advanced", which could be beneficial for margins in future reporting periods.

Sonic Healthcare can benefit from several new technology sources, including PathologyWatch, AI, and its involvement with Microba Life Sciences Ltd (ASX: MAP), to help its future earnings.

Growing dividend

I don't know for sure what the Sonic Healthcare share price is going to do. But, the ASX healthcare stock's ongoing dividend growth can provide 'real' returns while we wait for a recovery. It said it has a progressive dividend policy.

According to the estimate on Commsec, the company could pay an annual dividend per share of $1.08, which would translate into a forward dividend yield of 4%, excluding franking credits.

Appealing valuation

After the recent decline of the Sonic Healthcare share price, it's now valued at under 19 times FY25's estimated earnings, which I think is very reasonable for a business in a defensive industry like healthcare.

Due to its fairly large market capitalisation size, I'm not expecting huge gains, but I believe it can be a steady compounder and outperform the S&P/ASX 200 Index (ASX: XJO) over the long term, at the current Sonic Healthcare share price. I'm thinking about buying some Sonic Healthcare shares for my own portfolio at the current level when Motley Fool's trading rules allow me to.