Defensive S&P/ASX 200 Index (ASX: XJO) share Transurban Group (ASX: TCL) could be a candidate to do very well once interest rates start falling.

For readers that don't know, Transurban is the business behind a number of toll roads in Sydney, Melbourne and Brisbane. It also has a presence in North America as well.

The business recently reported its FY24 first-half result to investors for the six months to 31 December 2023.

Growth continues

It revealed that average daily traffic (ADT) increased 2.1% year over year to 2.5 million trips, supported by growth in all regions and the opening of new assets.

Proportional toll revenue rose by 6.3%, which led to proportional earnings before interest, tax, depreciation and amortisation (EBITDA) rising to $1.33 billion.

The statutory net profit after tax (NPAT) increased by 318% to $230 million.

Transurban also reported free cash (including capital releases) of $1.4 billion (up $63.5%) and a 13.2% increase of the distribution per security to 30 cents.

The defensive ASX 200 share reaffirmed its FY24 distribution guidance of 62 cents per security, which is expected to include approximately 4 cents per security of WestConnex cash, previously held during construction.

What to make of Transurban shares?

The Australian Financial Review reported that broker Citi has put a buy rating on the toll road operator.

Transurban is expecting to increase its FY24 distribution per security by 6.9%, and Citi thinks the defensive ASX 200 share could beat this guidance.

The broker suggests that Transurban could be a significant beneficiary of lower interest rates, partly because of the amount of debt on its balance sheet. It's also possible that the defensive ASX 200 share has the potential to make more acquisitions.

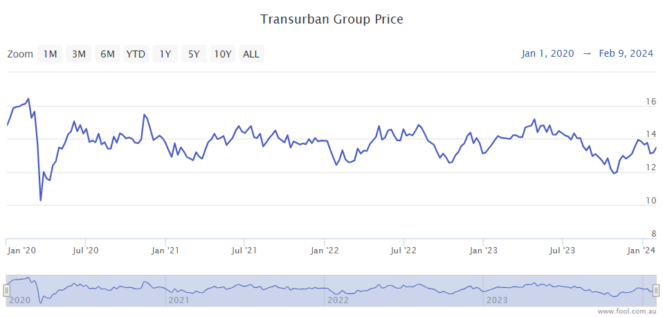

Transurban share price snapshot

If the business does pay an annual distribution per security of 62 cents, it would translate into a forward distribution yield of 4.8%.

Since the start of 2024, the Transurban share price is down 6%.

I'd agree with Citi's assessment – if interest rates do start coming down, Transurban could materially benefit. But, interest rates are, in my opinion, going to stay higher for longer than some people are expecting. I'm not expecting huge gains for Transurban in the next year, but I think it could regain some of the lost ground in the medium term.