ASX shares could get a nice boost this week as the Reserve Bank of Australia board meets on Tuesday.

The big question is whether inflation has calmed sufficiently that interest rates no longer have to be moved up.

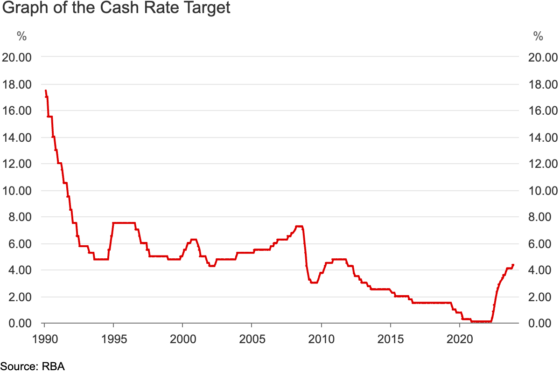

Have Australian consumers and businesses copped enough pain after 13 rate hikes over the past two years?

According to a survey conducted by comparison site Finder, all 27 economic experts are tipping the central bank will keep on hold.

REA Group Ltd (ASX: REA) economic research director Cameron Kusher said there "seems to be no hard evidence to point to that suggests the RBA will lift rates".

"Inflation has come in well below the RBAs forecast, retail sales have slowed and the unemployment rate has lifted and job creation has stalled."

A pause in rates could raise consumer and business confidence, which in turn could be bullish for stock markets.

When are interest rate cuts coming?

The next question for investors and consumers alike is whether interest rates will actually come down soon.

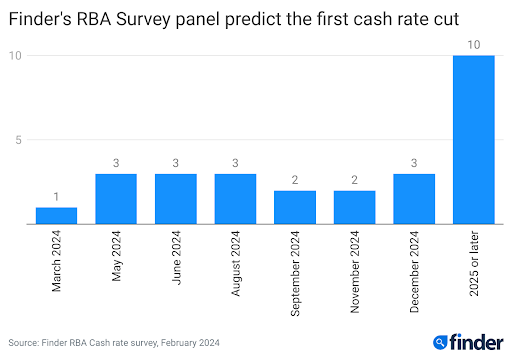

On this, the experts are more divided.

Ten of the 27 economists believe the first cut will come in the second half of this year, while another 10 are tipping it won't arrive until next year or beyond.

Two of them even think the RBA hasn't even finished raising its cash rate.

There are two stumbling blocks for rate relief: the federal government's adjustments to the stage 3 tax cuts, and still-persistent inflation.

Corinna Economic Advisory economist Saul Eslake believes the RBA will not be cutting rates at all this year.

"The tax cuts due on 1 July are equivalent in terms of their impact on household cash flows to two 25 basis point rate cuts, albeit that their distributional impact is very different."

University of Sydney associate professor Mark Melatos also warns against expectations that mortgage repayments would come down anytime soon.

"Inflation remains above the RBA's target band, despite moderating in recent months.

"As long as low unemployment — effectively full employment — persists, the cash rate is unlikely to be reduced and further increases remain a possibility."

Bendigo and Adelaide Bank Ltd (ASX: BEN) chief economist David Robertson is slightly more optimistic.

"The next move will most likely be a cut around year end," he said.

"Earlier cuts are possible if services inflation improves, but that will take time."