There are several reasons why I find the Brickworks Limited (ASX: BKW) share price particularly attractive right now.

Brickworks shares have climbed more than 10% in two months. While I'd prefer to have bought them at the price they were trading at two months ago, I believe it's still worth buying great stocks after a rise because they can keep delivering value.

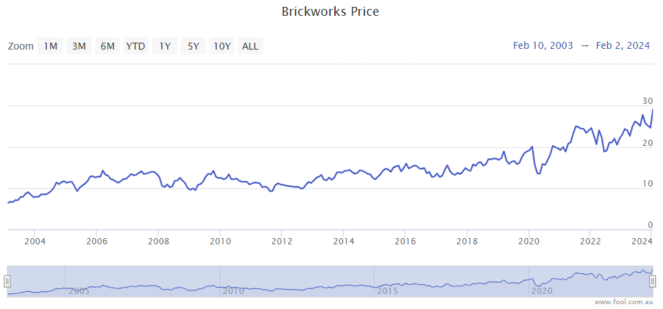

The Brickworks share price has hit 52-week highs plenty of times since 2000, as we can see on the chart below. At each of those previous 52-week highs, it would have been a mistake to think the share price was too expensive to reach even greater heights.

From everything I've seen, many of the well-established companies keep winning, just like how a great athlete keeps doing well until they get too old.

Brickworks is many decades old, but I'd suggest that's a positive – its longevity is a sign of stability. There are (at least) three more reasons why it could still be a great buy.

Building product demand to rebound?

Brickworks is one of the largest building products companies in Australia. It's the country's biggest brickmaker but is also involved in other businesses. These include Austral Masonry, Bristle Roofing, Southern Cross Cement, Capital Battens and Terracade.

New home building has reportedly fallen to a decade low, according to reporting by the Australian Financial Review. That's not exactly a positive for Brickworks.

But, with Australia's ongoing population growth, I think there's underlying future demand for building products in the future.

When interest rates start being reduced in Australia, this could accelerate demand for building products with a recovery of construction and renovation activity.

I fully expect Brickworks' building product earnings to be cyclical, and sometimes there will be pain. But, it could be useful to look at Brickworks shares as a possible opportunity during times of demand weakness, such as now.

Ongoing success with its industrial properties

Brickworks has a large and growing joint venture that builds advanced industrial properties on land that was surplus to Brickworks' manufacturing requirements.

By unlocking the value of that land, Brickworks gets a cash injection which it can use to pay down debt or for another purpose. The industrial properties create a pleasing net rental profit, and it also leads to a development profit after the completion of building.

The joint venture is seeing "strong lease enquiry for large-sized industrial facilities". I think this bodes well for the foreseeable future.

High interest rates are hurting the valuation of these assets in the short term, but the rate cuts could help in the future and make them even more valuable than they already are.

The growing net rental profit is helping fund larger dividends over time for owners of Brickworks shares.

Excellent investment

The other key thing to know about Brickworks is that it owns a significant number of shares in Washington H. Soul Pattinson and Co. Ltd (ASX: SOL).

Soul Patts is a large investment business that invests in many varied sectors including telecommunications, resources, financial services, property, credit/bonds, swimming schools, agriculture and so on.

Soul Patts also owns a significant number of Brickworks shares. This has been a beneficial cross-holding that has lasted for decades and could continue for a long time.

Soul Patts' returns have given Brickworks growing dividends and capital growth. The stability of that business helps offset the cyclical nature of the building products profit.