You've likely noticed that ASX uranium stocks are getting a lot of attention of late.

And for good reason.

Uranium shares have been booming over the past year amid soaring uranium prices.

Yellowcake is now trading for around US$106 per pound. That's more than double the roughly US$50 that same pound was worth a year ago.

The huge price spike comes as an ever-growing number of nations are building, or planning to build, new nuclear power plants to provide reliable, emissions-free baseload power. At the recent United Nations Cop28 climate conference in Dubai, 22 nations pledged to triple their nuclear power capacity.

That's seeing demand surge faster than producers can increase their supplies.

Today ASX uranium stocks are getting another big boost following an overnight update from Kazakhstan-based Kazatomprom.

The world's top uranium producer reiterated concerns that supply issues with sulphuric acid, crucial for its ISR uranium mining method, will impact its production levels in 2024.

With that said…

Why this ASX uranium stock tops my list

While there are a number of quality miners to choose from, S&P/ASX 200 Index (ASX: XJO) uranium stock Boss Energy Ltd (ASX: BOE) tops my list of ASX uranium stocks to cash in on the ongoing production woes.

Boss Energy, with a market cap of $2.5 billion, is primarily focused on its Honeymoon Uranium Project, located in South Australia.

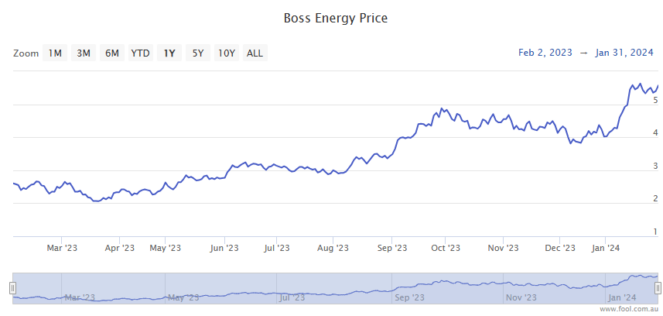

As you can see in the above chart, the Boss Energy share price has rocketed 128% over the past 12 months. And shares are already up 40% in 2024.

That massive growth saw the ASX uranium stock added to the ASX 200 as part of the December 2023 quarterly rebalance. This should offer some added support, opening the door to more fund managers, often limited to the larger end of the market, to invest in Boss.

It was also pleasing to see Boss commence its first mining activities at Honeymoon in October.

And the ASX uranium stock is set to become a multi-mine uranium producer after acquiring 30% of the Alta Mesa Project in the United States earlier in December.

"This project has many key similarities to Honeymoon and will enable us to diversify our production base on both a project and geographical basis while driving growth in our production and cashflow," Boss Energy managing director Duncan Craib said of the acquisition.

The past quarter also saw Boss enter into its first binding sales agreement with a major publicly listed US power utility. The agreement will see the company sell 1 million pounds of uranium from Honeymoon over a seven-year period. That's set to commence in 2025, with uranium to be sold at market-related prices.

Boss Energy's balance sheet is also quite strong.

As at 31 December, the ASX 200 uranium stock had no debt, cash of $227 million and a uranium stockpile valued at $202 million.