Australia is fortunate to host a huge group of excellent dividend stocks, but I still prefer investing in ASX growth shares.

That's not necessarily because dividend shares don't perform. It's just more about the enjoyment of the investment process.

There are two facets to this.

First is that I find growth shares less maintenance. With dividend stocks, you need to worry about reinvesting the income, which adds time and effort for more research and the tax implications.

The second advantage is that I derive pleasure in watching businesses I have invested in growing to the next stage. It's exciting.

If you agree with my arguments, there are a couple of ASX growth shares that are looking pretty good to pick up right now.

But if you commit, just be prepared to be in it for the long haul:

How about a 1,500% return in 5 years?

Telix Pharmaceuticals Ltd (ASX: TLX) is an Australian company developing diagnostic and therapeutic products for different types of cancer.

I like its long-term prospects because the business is at a sweet spot in its life cycle.

In 2022, Telix released its first product into the commercial market, thereby generating its first flow of real revenue.

Since then, that income has allowed it to progress future products through the arduous testing and approval pipeline and head towards profitability.

The next few years could see the fruits of those activities, which could put a rocket under the share price.

Professional investors are bullish, with all eight analysts surveyed on CMC Invest currently rating Telix as a buy.

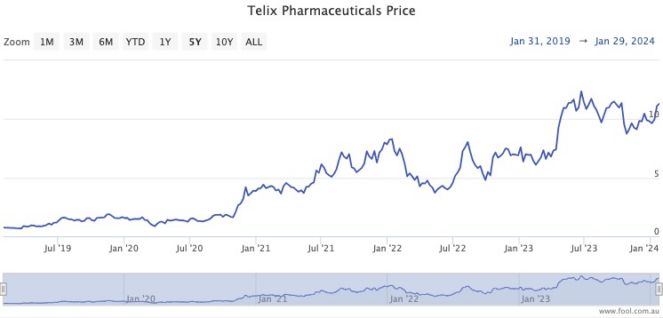

Telix shares have returned an incredible 1,494% over the past five years.

These ASX growth shares have tripled in 19 months

Life360 Inc (ASX: 360) sounds like a creepy mobile app, but it seems to be popular in the US.

It's a "family locator" app that allows parents to track the whereabouts of their children. Similarly, it can also be used for family members to monitor their elderly relatives.

There are also safety features such as car crash detection, calling for roadside assistance, and SOS alerts.

According to a company presentation made at a conference in November, about 10% of families in the US use the app.

What about the business though?

After tech shares started selling off in 2022 due to inflation fears, the management declared that it would turn from a cash-burning startup to a more mature business focused on profitability.

The market has appreciated the pivot, sending the Life360 share price tripling since June 2022.

Co-founder and chief executive Chris Hulls said in a quarterly update in November that Life360 continues to improve its cash flow.

"We continue to carefully balance expense management with investment in the significant long term growth opportunities available to us.

"Excluding commissions, operating expenses increased by $1.2 million or 2.4% YoY, compared with a $21.5 million or 38% uplift in revenue, demonstrating the operating leverage of Life360's business model."

Just like Telix, this one's popular with those who invest for a living.

According to CMC Invest, seven out of eight analysts rate the tech stock as a buy.