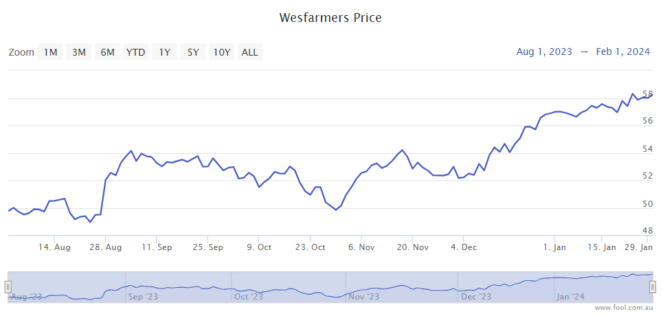

The Wesfarmers Ltd (ASX: WES) share price has climbed impressively over the last six months, rising by 15%. The S&P/ASX 200 Index (ASX: XJO) has only gone up by 2% over that same time period.

A 15% rise is nowhere near as much of a gain as plenty of other businesses. For example, the JB Hi-Fi Limited (ASX: JBH) share price is up 22% and the Fortescue Ltd (ASX: FMG) share price has gone up 35%.

Would it be crazy to invest now?

Wesfarmers is one of the best businesses on the ASX, in my eyes. It operates a number of leading businesses like Bunnings, Kmart and Officeworks.

I don't think it would be a stretch to invest today. The forecast on Commsec puts the Wesfarmers share price at 24 times FY25's estimated earnings. With the underlying quality of Wesfarmers, this doesn't seem like an expensive valuation.

The company has done a wonderful job of growing over the long term. It has directed capital towards its strong businesses and moved away from areas it doesn't think will deliver for shareholders over the long term.

Its move into healthcare is just the kind of thing I'd expect from Wesfarmers because of the long-term growth potential, an ageing population and the digitalisation of healthcare tailwinds. Healthcare is a huge industry, so it makes a lot of sense for Wesfarmers to create a new platform for growth here.

Population growth and the prospect of lowering interest rates are exciting for the potential of earnings growth and Wesfarmers share price growth over the next two or three years.

At the AGM, Wesfarmers indicated that the value offering of Kmart and Bunnings was resonating with customers. This bodes well if there's an extended period of economic challenges for some households.

Don't go all in

Investors seem to have become exuberant that inflation is reducing, but there haven't actually been any interest rate cuts yet.

Sometimes the market can get ahead of itself and then adjust after that.

It's not as though companies are suddenly being expected to make a lot more profit than they were before. Thus, this rally seems to be based on sentiment about interest rates. In fact, the US Federal Reserve boss has told investors not to expect cuts too early.

There's no rush to invest. If the last four years have shown us anything, it's that volatility usually isn't that far away. We don't need to FOMO invest in any particular ASX share, including Wesfarmers shares.

Over the long-term, I think Wesfarmers shares can keep rising, but there may be times when it falls below today's price.

Even so, I'd be comfortable buying a parcel of shares today and buying more in the future at a price I like.