There is arguably nothing more fun in investing than picking up a stock when no one else is interested, then watching it rocket to the moon.

If you missed out on the ride, then the consolation prize is imagining how much money you would have if you did invest early enough.

Regular readers would know that ASX uranium stocks have been on fire lately, but even by those standards there is one stock that had a particularly excellent 2023.

Let's check it out:

Who's the Boss?

Boss Energy Ltd (ASX: BOE)'s main business is the Honeymoon Uranium Mine in South Australia.

Under the previous owner the mine started producing in 2011. But rock-bottom global prices for uranium after the Fukushima disaster forced suspension of operations in late 2013.

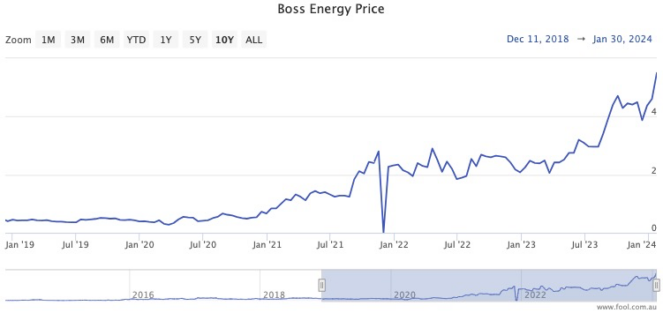

Boss Energy bought the mine in 2015 but it lay dormant, meaning for many years the share price languished in penny stock hell.

In June 2021, the company announced it would conduct an Enhanced Feasibility Study (EFS) to see whether Honeymoon was sufficiently viable to restart mining.

The results of that study recommended changes to the processing plant to improve the economics for every kilogram of uranium produced.

Wonderful timing for this uranium stock

All this work came along at an incredibly fortunate time.

In February 2022, Russia invaded Ukraine. Almost immediately the world's energy market plunged into crisis.

Nuclear power, which had been out of favour for 11 years since Fukushima, all of a sudden looked attractive to nations seeking energy security.

Uranium prices soared for much of 2023 due to this surge in demand.

Dormant mines around the world scrambled to resume production, but it's a significant task requiring time and money.

Boss Energy was a step ahead of the rest, thanks to conducting that feasibility study in 2021.

How one winner can carry a bunch of losers

In July 2019, you could still buy Boss Energy shares for 36 cents apiece.

Let's say you had the foresight to buy $40,000 worth back then.

Over the last couple of years the market has recognised the huge potential and advantage for Boss Energy.

On Tuesday Boss Energy shares were trading around $5.44.

This means that the $40,000 you put in not even five years ago would now be $604,444.

Remember, this case study isn't to encourage you to go for get-rich-quick schemes.

It's to point out that one or two winners can make all the difference in your ASX stock portfolio. You don't have to aim for perfection.

Consider this.

At the time you bought Boss Energy shares, you might have bought nine other stocks for $40,000 each to diversify your investments.

Even if all nine of those somehow went to $0, your portfolio would still be 75% in the black.

Crazy, but that's maths for you.