The BHP Group Ltd (ASX: BHP) share price is under selling pressure today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining stock closed on Friday trading for $47.54. In morning trade on Monday shares are swapping hands for $46.83 apiece, down 1.5%.

For some context the ASX 200 is up 0.02% at this same time.

The BHP share price is in the red despite another small uptick in the iron ore price over the weekend. The industrial metal is selling for US$135.60 per tonne.

Comparing apples to apples, rival ASX 200 miner Rio Tinto Ltd (ASX: RIO) shares down 0.1%, while the Fortescue Metals Group Ltd (ASX: FMG) share price is up 1.1%.

This comes amid media reports that BHP shareholders could be looking at billions of dollars in legal damages related to the 2015 Samarco Fundao iron ore tailings dam collapse in Brazil.

The collapse killed 19 people and caused massive environmental damage.

Here's the latest.

BHP share price pressured amid court ruling

The BHP share price is down today as ASX investors consider the potential implications of the ruling on the Fundao Dam, which was owned and operated by Samarco Mineracao, a joint venture between BHP Brasil and Vale.

As Reuters reported, Brazilian federal court judge Vinicius Cobucci has ruled that BHP, Vale and their Samarco joint venture must pay 47.6 billion reais (US$9.7 billion, or AU$14.8 billion) in damages for the collapse.

According to the ruling, the legal damages will be used for local improvement projects in the impacted areas.

However, investors may be prematurely pressuring the BHP share price after the ASX 200 miner released a statement saying it "has not been served with a decision by the court".

Management said they "will review the decision to assess its implications, the potential for an appeal and any potential impact to the group's provision related to the Samarco dam failure".

The miner noted:

Since early CY2021, the parties have been engaging in negotiations to seek a settlement of obligations under the Framework Agreement and BRL$155bn Federal Public Prosecution Office claim and the negotiations are expected to resume in February 2024.

The company said that, as reported in its 2023 annual report, the group's provision related to the Samarco dam failure is US$3.7 billion (as at 30 June 2023).

"BHP Brasil is fully committed to supporting the extensive ongoing remediation and compensation efforts in Brazil through the Fundacao Renova," the miner stated.

Fundacao Renova is a not-for-profit, private foundation. It was established after the damn collapse to implement 42 remediation and compensatory programs in Brazil.

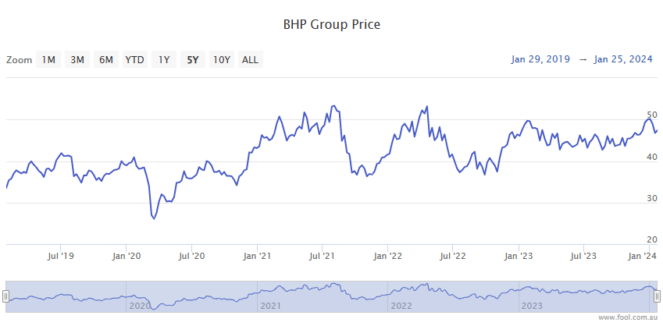

The BHP share price is down 5% over the past 12 months.