Do you have $500 spare to invest?

Because that's all you need if you have the patience to buy ASX shares for the long run.

Of course, it always helps to buy stocks for as low a price as possible. Each cent you don't spend on the initial outlay is a potential cent that will go towards profits later.

Here are two cheap ASX shares I think could be smart buys for investors that are willing to hold them for years:

Doubled in a year, but no doubt these are still cheap ASX shares

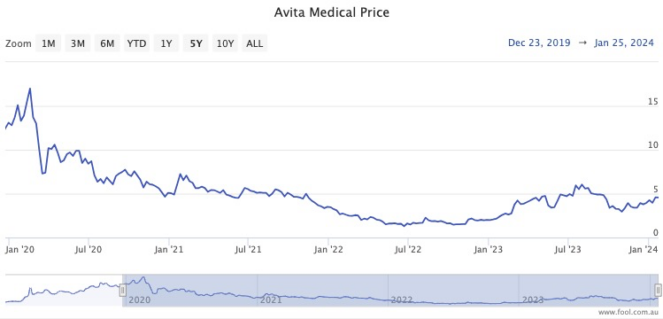

The Avita Medical Inc (ASX: AVH) share price has more than doubled over the past year, so it might seem absurd that I'm calling it "cheap".

But the stock is still down more than 70% from its pre-COVID high.

The biotechnology stock makes regenerative products for burns patients. The nature of the sector means supreme patience is required from investors for products to go through all the testing and approval hurdles.

Professional investors are bullish on the future for Avita Medical.

According to CMC Invest, nine out of 10 analysts covering the stock are rating it as an add. Among those, eight think it's a strong buy.

Multiple tailwinds for this US giant

Block Inc CDI (ASX: SQ2) shares have halved since April 2022, so it's certainly looking cheap right now.

But the ASX stock only listed in January 2022 after the US giant acquired Australia's Afterpay.

If you look at the track record of the original stock, Block Inc (NYSE: SQ), the current discount is even more astounding.

From its August 2021 peak, the Block share price is now down more than 77%.

The fintech has multiple factors running in its favour for the coming years.

First is that interest rate rises may have peaked and some cuts might even be around the corner. That will be a boost for growth stocks and consumer-facing businesses like Block Inc.

Second is that the business has consciously made an effort recently to reduce costs and reckless stock dilution to remunerate staff.

The third is that its interests in cryptocurrency could soon become a tailwind rather than a burden, as that market emerges from a multi-year winter.

Already Bitcoin (CRYPTO: BTC) has rocketed 42% in value over the past six months, with the approval and launch of spot ETFs in the US giving it a major long-term push.

All three analysts studying Block Inc rate it a strong buy right now, according to CMC Invest.