Some S&P/ASX 200 Index (ASX: XJO) dividend shares offering attractive yields today may not look nearly so attractive 10 or 20 years down the road.

The world is changing faster than ever before.

And with it, the future demand for services and commodities is likely to see some major transformations as well.

But some ASX 200 dividend shares will stand the test of time far better than others.

While there are no guarantees in life or in the stock markets, below we'll look at three blue-chip ASX companies I believe you could safely hold for decades of reliable passive income.

Three ASX 200 dividend shares to buy and hold onto

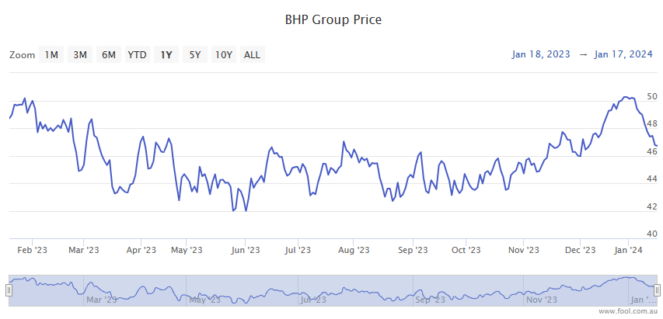

First up, we have mining giant BHP Group Ltd (ASX: BHP), the largest stock listed on the ASX.

With its vast land holdings and diverse operations, I believe this ASX 200 dividend share is well-positioned to adjust to the world's changing commodity demands.

BHP currently derives most of its revenue from iron ore, with copper coming in at number two. But the miner also has a large exposure to uranium. And, if desired, it has plenty of cash and scope to enter the lithium space or other minerals that may be in greater demand in 2050 than they are today.

BHP currently trades on a 5.7% fully franked trailing dividend yield.

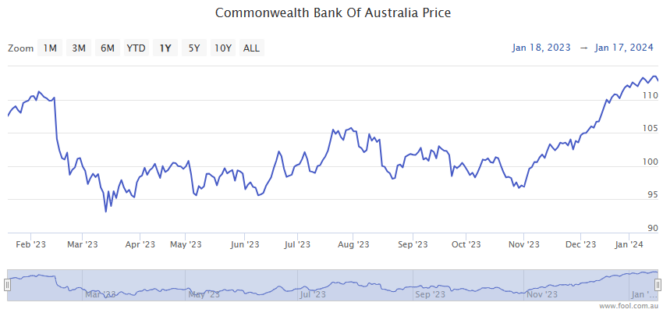

Which brings us to our second ASX 200 dividend share to buy and hold for decades, Commonwealth Bank of Australia (ASX: CBA).

The biggest bank stock in Australia, CommBank offers a wide range of integrated financial services.

As the requirements for these services change over the decades, I believe CBA is well-placed to adapt to and, indeed, be a front runner on these changes.

CBA currently trades on a fully franked trailing dividend yield of 4.0%.

Rounding off the list of ASX 200 dividend shares I think you could safely hold for decades is retail stock JB Hi Fi Ltd (ASX: JBH).

Over the coming years, I reckon the demand for electronics of all shapes and sizes (some we've yet to even think up) will only continue to tick higher.

As with the above two blue-chip stocks, I think JB Hi-Fi is well-positioned to adapt to that shift in consumer demand, embracing items like those AI-enabled homewares everyone will just have to have.

JB Hi-Fi currently trades on a fully franked 5.4% trailing dividend yield.

Looking over the horizon

Now, to be sure, the passive income delivered by these three ASX 200 dividend shares will vary over the decades. Some years their yields may be higher than what we see today. Others, they may be lower.

But I do believe they'll all be strong market players and income payers for many, many years to come.