Would you like to generate some investment income this year?

ASX dividend shares are the obvious place to go but, as tempting as they are, investors need to be wary of high dividend yields.

Stocks that pay out 12%, 15% and 20% yields could well be in that position because its share price has fallen off a cliff.

The other worry is that such a high payout is a one-off and is not sustainable beyond a year or two.

Fortunately, the experts at the IML Equity Income Fund revealed a couple of income gems that they possess that are looking ripe for a great 2024.

They both hover around the 7% mark for yield, which is certainly respectable, but importantly the businesses have excellent prospects.

So if you have $20,000 to invest, you could consider going halves in each of these:

A foot in each revival

With interest rates pretty close to the peak and maybe even heading this year, both real estate and retail could soon hit the boom part of its cycle.

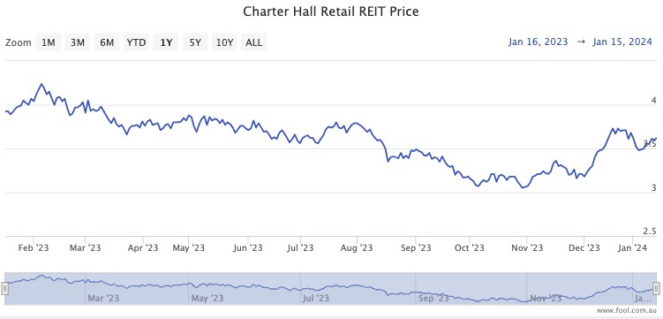

As such, last month investors flocked to convenience retail real estate investment trust (REIT) Charter Hall Retail REIT (ASX: CQR).

"Charter Hall Retail REIT was up 18.9% on the back of lower bond yields and reconfirmation of its earnings and distribution guidance," an IML memo to clients read.

"Also, $225 million of asset sales at book value reduced its gearing and highlighted the continued solid demand for high-quality, well located neighbourhood shopping assets."

Charter Hall Retail is paying an unfranked 7% dividend yield.

The IML team is continuing to back the REIT for a big 2024.

"We continue to like CQR given its large trading discount to net tangible assets, majority CPI-linked rents and attractive dividend yield."

The ASX dividend shares that could be past the worst

The Australian casino industry has been under fire the past couple of years, and New Zealand company Skycity Entertainment Group Ltd (ASX: SKC) is no exception.

The shares dived 5.6% last month, which the IML team put down to an announcement of "modestly lower" 2024 earnings guidance and the departure of its chief executive.

"It also agreed to settle its Auckland carpark dispute on terms we believe are incrementally favourable."

In Australia, the business is facing regulatory scrutiny.

"The Austrac settlement and Adelaide casino review remains the major overhang."

Despite all these headwinds, the IML analysts reckon a 22.2% drop in share price since the start of September adequately reflects future adversity.

"We expect [the Adelaide review] to be completed within six months and any penalty to be more than accounted for in the share price."

As a foreign company, the dividends from Skycity are also unfranked, but the yield does amount to a handsome 6.65% currently.