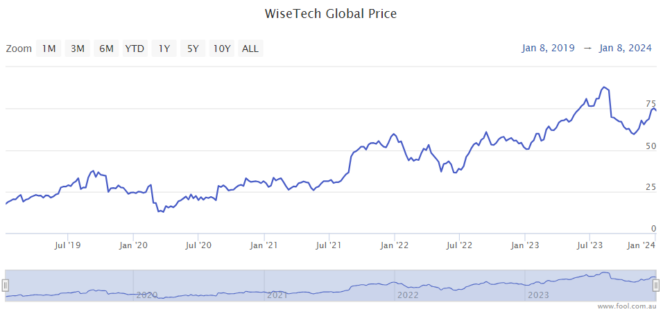

The WiseTech Global Ltd (ASX: WTC) share price has done fabulously well for long-term investors. In just the past five years it has risen by more than 260%.

There aren't many S&P/ASX 200 Index (ASX: XJO) shares that have done as well as WiseTech shares in the last few years.

As we can see on the chart above the company has seen plenty of volatility in the last few years, and it's down close to 20% from the peak in 2023.

However, with the price/earnings (P/E) ratio still above 100 at the current WiseTech share price, it's worth asking the question about whether this ASX tech share is significantly overpriced.

Strong growth tailwinds

The company describes itself as a leading developer and provider of software solutions to the logistics execution industry globally. Its customers include over 17,000 of the world's logistics companies across 174 companies, including 44 of the top 50 global third-party logistics providers and 24 of the 25 largest global freight forwarders worldwide.

Its software, CargoWise, has become an essential part of the global logistics infrastructure.

I think the amount of global goods moving around the world is going to increase in the next few years, even if that's just from the increasing global population.

With more e-commerce, an evolving global supply chain and more people entering the middle class, I think the company has a good growth outlook.

In FY23, the company saw total revenue growth of 29% to $816.8 million, with CargoWise revenue up 41% to $659.6 million thanks to increased usage by existing customers and new customer signings. In the 2023 financial year, 96% of its revenue was recurring, and it lost less than 1% of its customers. The growth rate can have a major effect on the WiseTech share price.

It seems the business is extremely popular with existing customers (who keep spending more) and its revenue base is increasing.

In FY24, revenue is expected to grow by between 27% to 34%, up to $1.1 billion. CargoWise revenue could grow by between 34% to 43%.

Profit margins impacted

Earnings before interest, tax, depreciation and amortisation (EBITDA) in FY24 is expected to grow by between 18% to 27% to between $455 million to $490 million, which is slower than the revenue growth.

Software is normally very scalable – once the software has been developed, additional users are a bonus and should largely help boost margins.

So, why is FY24 going to see slower profit growth?

There are the recent small acquisitions of MatchBox Exchange and Sistemas Casa and their associated upfront acquisition costs. Integrating acquisitions takes time and costs. It's expecting EBITDA margins to return to above 50% in FY26.

Does the WiseTech share price make sense?

The company is valued at around 110 times FY23's estimated earnings. That's a very high price/earnings (P/E) ratio compared to most businesses. But, if the company keeps growing profit strongly, then the valuation could quickly make sense.

On Commsec, the earnings per share (EPS) is projected to rise to $1.10 in FY25 and $1.46 in FY26. This would put the WiseTech share price at 64 times FY25's estimated earnings and 48 times FY26's estimated earnings.

If WiseTech's profit keeps growing at a strong double-digit rate over the coming years, today's price could seem cheap in five years.

A lot of that growth though, is already expected by the market, which is why it's priced as highly as it is. But I wouldn't call it horribly overvalued based on its economics and long-term growth outlook.

I'm not sure I can argue it's cheap today, particularly in this high interest rate era. But, I don't think it's horribly overvalued. Over the past decade, Microsoft, Alphabet and Meta Platforms have been called overvalued a lot, yet they kept rising as earnings justified the higher share prices.

WiseTech seems to be one of the very best businesses on the ASX, but it's certainly possible the WiseTech share price could become better value during 2024.