For how many years has the elusive multi-bagger stock slipped from your grasp? Finding companies to invest in to deliver a multiple return (100% or more) is no easy feat. Or maybe it's an achievement you've already unlocked, but finding another wealth-multiplying investment is on your New Year's resolution list.

Whatever the case, I'm in the same boat in 2024. I'm thinking big this year as I ponder where to deploy idle cash.

While still in the early innings of my tenure on this floating rock (touch wood), I want to take the calculated risk to sprinkle a pinch of multi-bagger potential into my portfolio. These are investments that I'd invest only a small amount (1-2% of my holdings) due to their high-risk nature. However, often a little goes a long way here.

After some digging, here are the three ASX stocks I uncovered.

Potential multi-bagger stocks hiding in the dark

I prefer to look where few others are when searching for potentially lucrative opportunities. This often tends to be the smaller end of town. Moreover, inspecting companies the market has soured on can also be fertile soil for finding multi-baggers in the making.

Let's take a look.

Hansen Technologies Limited (ASX: HSN)

Hansen Technologies rarely comes to mind first when discussing ASX tech shares. Yet, this unassuming software provider has grown its revenue nearly fourfold over the past decade. During this time, the company has witnessed its market capitalisation swell from $204 million to $1 billion.

While perhaps not as flashy as other software names, Hansen's product suite is integral to businesses in the energy, utilities, and communications industries. I believe that investors are overlooking the increasing relevance of the company's offerings amid the growing complexity of our energy grid.

At a price-to-earnings (P/E) ratio of 24, the potential for growth appears to be getting downplayed here, in my opinion. I don't think the market has connected the dots on the possible green transition tailwind for Hansen Technologies.

The Hansen Tech share price is down 3.7% compared to a year ago, as shown above. I believe there could be a 100% upside from the current $4.95 price tag.

Genex Power Ltd (ASX: GNX)

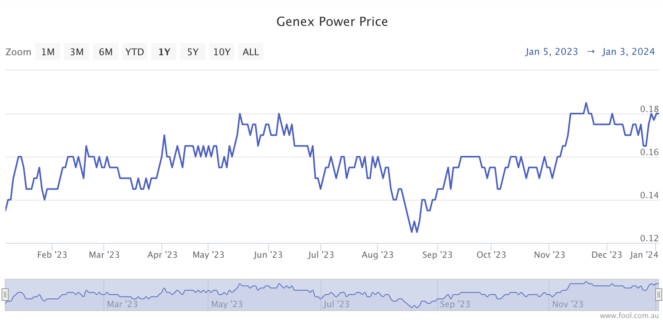

Next up is renewable energy project developer Genex Power. This is a much more speculative company than Hansen because it generates far less revenue ($23.8 million in FY23) and holds a mountain of debt ($617.2 million).

The company's success in becoming a multi-bagger stock hinges on bringing its Kidston pumped storage hydro project online without cost blowouts, in addition to future planned projects. If not, the financial fallout could be disastrous. However, the construction seems to be progressing well at this time.

By my estimates — to be taken with a grain of salt — Genex could be delivering roughly 500 gigawatt hours of energy by FY2025/FY2026. By comparing this with formerly ASX-listed Tilt Renewables, I estimate a potential upside of 220% in the coming years. However, there are still hurdles that Genex will need to overcome to get there.

The Genex Power share price is up 25% compared to a year ago, as shown above.

Task Group Holdings Ltd (ASX: TSK)

The last company which I think could become a multi-bagger stock is Task Group. At a market cap of $146 million, this little transaction management platform provider flies under the radar of most. Yet, the fundamentals look promising, in my view.

Task Group is responsible for the tech behind many of your favourite takeaway apps — Starbucks, Guzman Y Gomez, and McDonald's. Powering point-of-sale systems, loyalty programs, digital ordering boards, and online ordering — this company is a one-stop-shop for bringing the hospitality experience into the 21st century.

What do I like about this one? The revenue growth rate, high insider ownership, and the digitisation trend. Not to mention the debt-free, $30 million cash balance sheet primed for strategic acquisitions.

So, what could the market be missing here? Well, Task Group plans to integrate its own payments handling tech in the first half of FY2025. Currently, the company outsources this from providers such as Tyro Payments Ltd (ASX: TYR), missing out on the ticket clipping.

Once implemented, Task estimates a doubling in customer revenue from payment revenue. This, in my opinion, could be the multi-bagger catalyst for the stock.

The Task Group share price is up 22% over the past 12 months. Shares are currently fetching 42 cents apiece.