How good is the stock market?

Both US and Australian shares are putting on a rally to put a smile on investors' faces as Santa Claus prepares to intrude into homes.

The S&P/ASX 200 Index (ASX: XJO) is now up 6.1% over the past month, and if you compare it to the start of last month it's flying 10.6% higher.

Outstanding.

So what are the best deals right now that you can add to your Christmas stocking to brighten up 2024?

Here are three ideas:

Best deal #1: doubled this year, but more to come in 2024

Last week the big news coming out of the United Nations Climate Change Conference — commonly known as COP28 — was that nuclear power would play a significant role in reducing the world's carbon emissions.

As such, many experts are bullish on the global uranium price for the coming years, despite a steep climb already recorded in 2023.

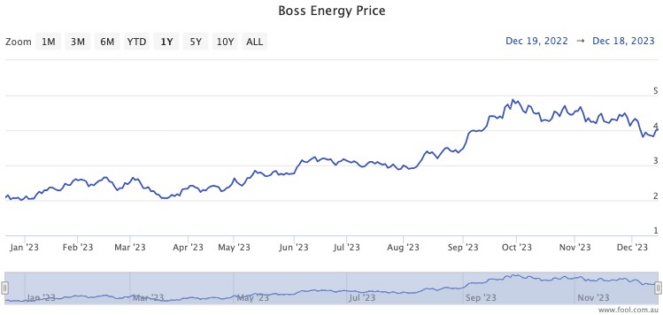

One ASX uranium miner that those in the know like is Boss Energy Ltd (ASX: BOE).

The share price has already doubled this year and risen more than 8% since COP28. But Bell Potter analysts this week thought there's more where that came from.

"Uranium fundamentals continue to support our pricing thesis which is based on advancement in Nuclear energy across the globe (60 reactors currently under construction) filtering through to a growing demand for U3O8, and a lack of near-term supply as producers exited the market post Fukushima."

Boss has its Honeymoon mine in South Australia due to restart operations this month, and it's also bought a 30% stake for the Alta Mesa project in Texas.

Best deal #2: Don't let short-term jitters put you off

Like Boss Energy, Avita Medical Inc (ASX: AVH) shares have been running hot in 2023 as well, now trading at almost double the value where they started.

However, it has come off the boil since the start of August, to the tune of a 38% decline.

This could present a buying opportunity for long-term investors.

The issues that have the market worried over the past few months seem to be largely transient: revenue downgrade and a slow progression through the Value Analysis Committee (VAC) processes.

The Motley Fool's James Mickleboro noted that Avita Medical will still achieve between 45% and 48% revenue growth for the year, even after the revision.

Tellingly, all 10 analysts that cover the stock think currently it's a buy, according to CMC Invest.

Best deal #3: Lithium will be back, baby

A depressed resources market has meant Mineral Resources Ltd (ASX: MIN) shares have had a tough time this year.

It's now down 29.4% from its January peak.

Global lithium prices falling off a cliff this year hasn't helped the cause, but most experts are expecting demand to pick up again over the long run.

Like Boss Energy, this is another play in the fight against climate change.

BW Equities equity salesperson Tom Bleakley this week labelled Mineral Resources shares as "good value".

"Mineral Resources has accumulated substantial stakes in quality lithium companies Wildcat Resources Ltd (ASX: WC8) and Azure Minerals Ltd (ASX: AZS)," he told The Bull this week.

"Mineral Resources' lithium exposure leaves it in a strong position as the industry matures."

According to CMC Invest, 13 out of 18 analysts currently rate the mining stock as a buy.