Experts say investors should never buy ASX shares based purely on merger and acquisitions potential.

However, if the stock is selling for cheap and the business is going well, then any such possibility is a nice bonus.

Novus Capital stock broker John Edwards this week had two mining shares in mind that he would buy, which could be on the radar of corporate raiders:

How would you like to multiply your money 31 times over?

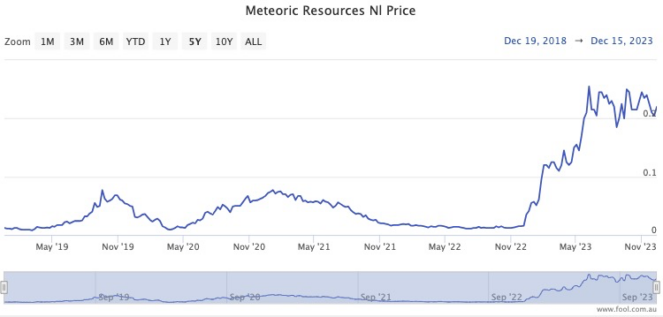

According to Edwards, the Meteoric Resources NL (ASX: MEI) share price was languishing at 1.6 cents on 5 December last year.

But, as of Monday afternoon, the stock is going for 22 cents.

That makes Meteoric Resources better than a 13-bagger in the space of just over 12 months.

Just incredible.

Edwards, who personally owns the mining stock, explained the meteoric rise.

"Earlier this year, Meteoric Resources acquired the Caldeira project — a tier-1 ionic clay rare earth element project in Brazil," Edwards told The Bull.

"The tenements are among the biggest and richest in the world."

And now the big boys are apparently circling.

"Speculation exists that this rare earths junior is a potential takeover target," said Edwards.

"I have a 12-month price target of up to 50 cents a share."

A 31-bagger in two years? Not bad.

'Most appealing' ASX mining shares

Even though the global gold price has trended upwards the last couple of months, De Grey Mining Limited (ASX: DEG) shares have disappointed.

The mining stock is down 1.7% so far this year.

Edwards is bullish on gold.

"The gold price recently exceeded US$2,000 an ounce and may keep increasing. A higher gold price could spark merger and acquisition activity."

For him, De Grey's Hemi site in Western Australia's Pilbara region is "most appealing" for takeover bids.

"Hemi is the third-largest undeveloped gold project in the world. Hemi's mineral resource estimate of 10.5 million ounces is likely to increase, which could attract interest from major gold companies needing to replenish their resource bases," he said.

"The project is relatively close to ports and other critical infrastructure."

Edwards has a "conservative" prediction that De Grey shares have a 36% upside over the next year.