This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

No company exemplifies the generative artificial intelligence (AI) boom more than Nvidia (NASDAQ: NVDA). As the market leader in designing and retailing advanced data center AI chips, the tech giant has enjoyed skyrocketing revenue and earnings as businesses scramble for its hardware to build and train large language models. Let's discuss Nvidia's third-quarter earnings and what they could mean for its future.

Nvidia's third-quarter earnings were a slam-dunk success

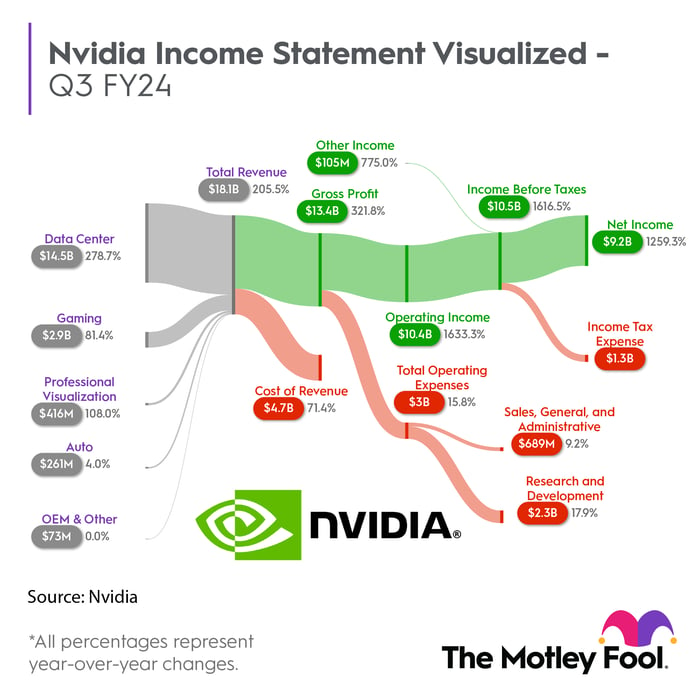

Nvidia's third-quarter earnings highlight its impressive operational momentum. Revenue soared 206% year over year to a record of $18.12 billion, driven primarily by the data center business, which involves the sale of advanced graphics processing units, such as the A100 (used to train OpenAI's ChatGPT) and its more advanced successor, the H100. All in all, this segment expanded 279% year over year to $14.51 billion.

Nvidia's bottom line also increased sharply, with net income jumping 12-fold to $9.2 billion due to rising sales of its high-margin computer hardware. With limited competition, Nvidia isn't under much pressure to lower prices to keep its 80% market share in AI chips.

Image source: The Motley Fool. OEM = original equipment manufacturer.

Nvidia can maintain its strength with its relentless technical innovation. This November, the company announced its new HGX H200, designed to make AI computing even faster.

It also enjoyed an impressive recovery in its gaming segment, which saw sales jump 81% year over year to $2.86 billion. The gaming results suggest the consumer market may finally be bouncing back from macroeconomic challenges, like inflation and high interest rates, which could mean more growth ahead.

I wouldn't worry about the competition

Nvidia's massive AI chip business isn't escaping the notice of rivals. Other companies, like AMD, Amazon, and even Tesla, are working on their own data center chips to generate revenue or reduce their reliance on third-party hardware suppliers for AI training. Of these companies, AMD is likely the biggest threat because it expects to sell its AI chips to other companies instead of retaining them for internal use.

This year, the Nvidia rival released its flagship M1300 AI chip designed to compete with Nvidia's industry-leading H100 for training AI-related models. But while this new product will introduce competition, Nvidia should retain its lead because of its faster update cycle.

While AMD expects to ramp up M1300 production in its yet-unreported fourth quarter of 2023, Nvidia is already in full production of the H100, with a whopping 500,000 chips expected to ship this year -- rising to between 1.5 million and 2 million in 2024 By being faster to market at scale, Nvidia can ensure it maintains a technical lead over competing products, ensuring better pricing power and profit margins.

Priced for perfection? Not so much

Despite the impressive results, Nvidia's stock actually fell around 3% on Wednesday following the earnings announcement. According to Bloomberg, this has much to do with overvaluation, with some analysts believing the stock is already priced for perfection. But the situation is more complicated than it looks on the surface.

Granted, with a price-to-sales (P/S) ratio of 38, Nvidia is significantly pricier than the S&P 500's average of just 2.5. But that only tells half the story. The P/S ratio is a backward-looking metric comparing the current market cap to the previous 12 month's revenue. For a fast-growing company like Nvidia, this metric doesn't properly account for its growth rate or unusually high net income margin (51% in the third quarter).

With all that in mind, forward price-to-earnings (P/E) is a better way of valuing Nvidia because it uses projected future net income. And with its forward P/E of just 32 (compared to the market average of 25), Nvidia's stock still looks reasonably valued, considering its epic growth rate and potential to continue dominating the AI opportunity. It's not too late for investors to bet on its long-term success.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.